Livestock Risk Protection Insurance for Feeder Cattle in Mississippi

Important Note

Significant updates to the program occurred on July 1, 2019. Additional updates were announced on June 9, 2020, and implemented on July 1. These updates implemented a variety of changes:

July 1, 2019

- Feeder cattle, fed cattle, and swine coverage expanded to all states.

- Premium subsidy levels increased from 13 percent to 20–35 percent based on coverage level selected.

- Maximum number of head per endorsement changed to 3,000.

- Maximum number of head annually changed to 6,000.

- Price adjustment factor for predominantly dairy changed to 50 percent for both weight ranges

July 1, 2020

- Premium due dates moved to the end of the endorsement period

- Premium subsidy levels for coverage levels above 80 percent increased by an additional 5 percent.

- Previous (before July 1, 2020) and revised (after July 1, 2020) subsidy levels by coverage levels are shown in Table 1.

|

Coverage level |

Previous subsidy level (pct.) |

Revised subsidy level (pct.) |

|

|

Low |

High |

||

|

0.7 |

0.799999 |

35 |

35 |

|

0.8 |

0.899999 |

30 |

35 |

|

0.9 |

0.949999 |

25 |

30 |

|

0.95 |

1 |

20 |

25 |

Source: USDA-RMA, https://www.rma.usda.gov/Policy-and-Procedure/Bulletins-and-Memos/2020/PM-20-035

Overview

Livestock producers face multiple types and magnitudes of risk, including price/market risk and production risk. Livestock Risk Protection (LRP) insurance is a subsidized tool offered by the United States Department of Agriculture (USDA) Risk Management Agency (RMA) to protect producers from downside price risk in the cattle market. This tool is similar to other insurance products in that producers pay a premium to obtain coverage in the event of a detrimental loss. For the case of LRP, the potential detrimental loss is a decline in cattle market prices.

There are other price risk management tools available to livestock producers, such as futures contracts and options, but they are often unattainable for smaller producers due to relatively large contract sizes (50,000-pound contract size for a feeder cattle futures contract). In comparison, LRP performs very similarly to a put option. However, a key difference is that LRP does not require a minimum number of head to be insured in order to take advantage of the program. This makes LRP attractive to many Mississippi producers, both large and small.

It is important to note that LRP does not shield producers from any other form of loss; it only gives protection against potential declines in the cattle market. It is also not intended to boost producer profits, but to protect from drops in price. It does not guarantee the price for cattle at any particular local auction. Rather, it protects against declines in a national feeder cattle cash price index. Similar to a put option, an LRP policy provides downside price risk protection for a producer, while also allowing the flexibility of market participation if prices go up rather than down.

LRP Insurance Terminology

Producer Premium: the amount of money a producer must pay in order to obtain an LRP insurance policy.

Premium Subsidy: the percentage of the total premium subsidized by USDA-RMA.

Indemnity: the sum of money a producer collects at the end of the coverage period if the actual ending value is lower than the coverage price chosen by the producer.

Actual Ending Value: the Chicago Mercantile Exchange (CME) feeder cattle reported index multiplied by the price adjustment factor for the type of cattle insured.

|

Type of cattle |

Calves, steers, heifers, Brahman, dairy |

|

Ending weights |

Under 600 lb or 600–900 lb |

|

Coverage period |

13–52 weeks |

|

Coverage level |

70–100 pct. |

|

Maximum no. of head per SCE |

3,000 |

|

Maximum no. of head per year |

6,000 |

|

Minimum no. of head per SCE |

1 |

|

Ending weights |

Steers (pct.) |

Heifers (pct.) |

Brahman (pct.) |

Dairy (pct.) |

|---|---|---|---|---|

|

Under 600 lb |

110 |

100 |

100 |

50 |

|

600 to 900 lb |

100 |

90 |

90 |

50 |

LRP Feeder Cattle Contract Specifics

LRP insurance for feeder cattle can cover calves, steers, heifers, predominantly Brahman, or predominantly dairy cattle (Table 2). There are two categories for ending weights: less than 600 pounds and between 600 and 900 pounds. The available coverage periods for feeder cattle are 13, 17, 21, 26, 30, 34, 43, 47, or 52 weeks. Generally, a producer will choose the number of weeks from the date the LRP is purchased to the date they intend to sell the cattle. The producer can choose a coverage level between 70 and 100 percent of the expected ending value of the cattle. The available coverage levels each day will be quoted on the LRP page of the RMA website available at https://public.rma.usda.gov/livestockreports/main.aspx. A higher coverage level will result in a higher producer premium. The expected ending value is derived from the feeder cattle futures market and reflects the futures market expectation of what price will be at the end of the coverage period.

While there is no minimum number of head required to obtain LRP insurance, there are maximums. No more than 3,000 head of cattle can be listed under one Specific Coverage Endorsement (SCE), and only 6,000 head can be insured within a year (between July 1 and June 30). The CME feeder cattle price index is used in conjunction with the price adjustment factor (Table 3) to determine a coverage price and actual ending values. The price adjustment factors are used because the CME feeder cattle index is calculated using market prices in a 12-state region for 700- to 899-pound steers with no dairy or Brahma characteristics. Thus, the price adjustment factor (which is multiplied by this index) is used to calculate more accurate values given the differences in gender, breed, age, and weight of the cattle.

Indemnities

The indemnity is the amount of money a producer collects at the end of the coverage period if the actual ending value is lower than the coverage price chosen by the producer. If the actual ending value is greater than the coverage price, then no indemnity will be paid. A producer will also not receive an indemnity payment if the cattle are sold more than 30 days before the end of the coverage period end date, and the producer’s premium will not be refunded.

Availability

LRP insurance coverage is available for feeder cattle throughout the year for all states. Not all coverage levels or insurance periods are available every day. The available feeder cattle policies can be purchased on any weekday, excluding holidays. LRP policies are not available during “normal” business hours but can be purchased from the time the RMA publishes prices and rates (around 3:30 p.m.) until 9 a.m. Central Time the following day. There are a few instances in which LRP coverage could be unattainable: if government funding limits are reached, if the RMA’s online system is down, or if the required data is not available for determining rates or coverage prices. LRP coverage might also be unavailable if a news event or announcement has created an expectation for market conditions to fluctuate far from normal or if there are two or more consecutive days of price limit moves in feeder cattle futures contract prices.

How LRP Works and Producer Steps to Getting Coverage

Step 1: The livestock producer must find an LRP authorized agent (the RMA website has an agent locator link: https://www.rma.usda.gov/Information-Tools/Agent-Locator-Page

Step 2: The producer fills out an application to be approved through the RMA. This document only needs to be filled out once unless the producer is changing agents. Approval of this application does not mean the producer has coverage yet.

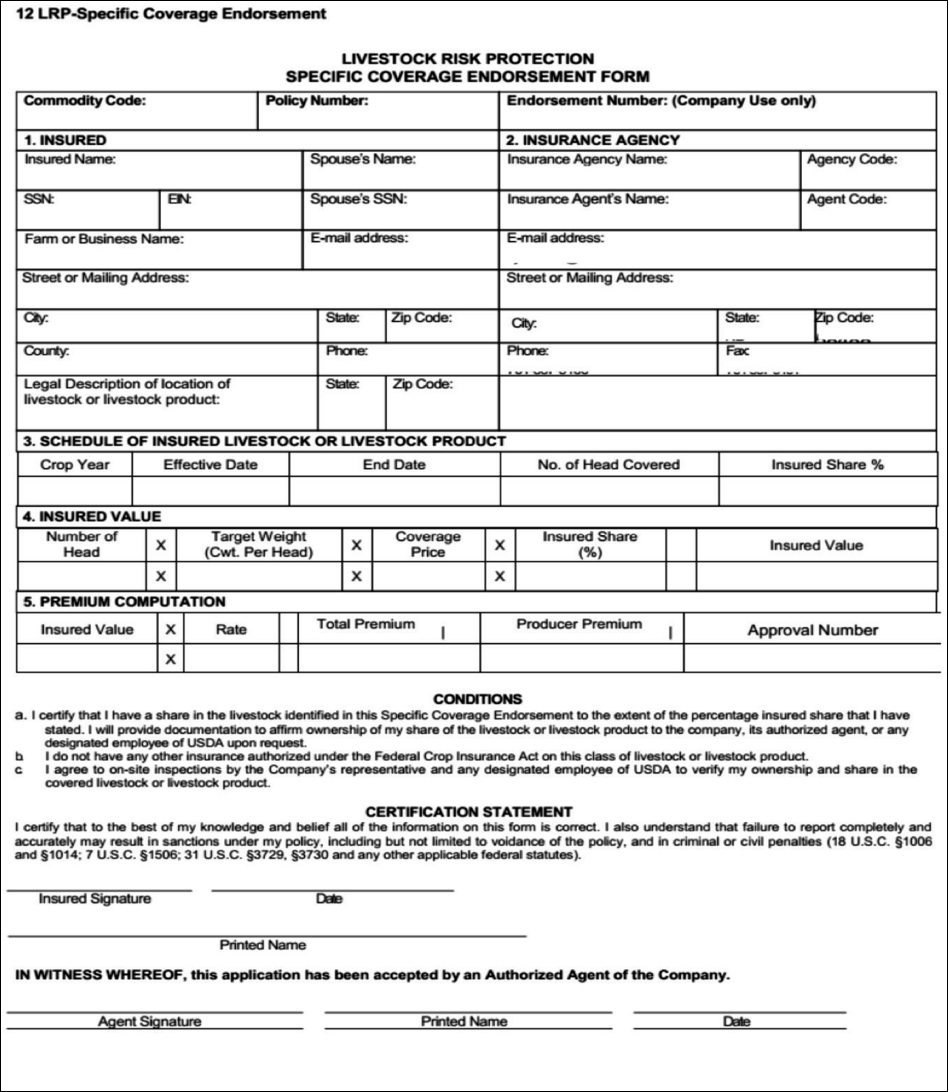

Step 3: In order to get coverage, the producer must purchase a Specific Coverage Endorsement (SCE). A sample SCE is shown in Figure 1. A new SCE must be completed each time a producer wishes to purchase coverage. Before July 1, 2020, the producer premium had to be paid on the day the insurance policy was purchased. The revisions that took effect on July 1 allow the producer premium to be paid at the end of the coverage period.

Step 4: At the end of the insurance period, if the actual ending value is less than the coverage price selected by the producer in the SCE, the producer will be owed an indemnity. Alternatively, if the actual ending value is greater than the coverage price, no indemnity will be paid.

Step 5: If the producer is owed an indemnity, he or she must submit a claim form within 60 days of the policy’s end date in order to collect the indemnity. Payments are made within 60 days of the claim.

LRP Feeder Cattle Example

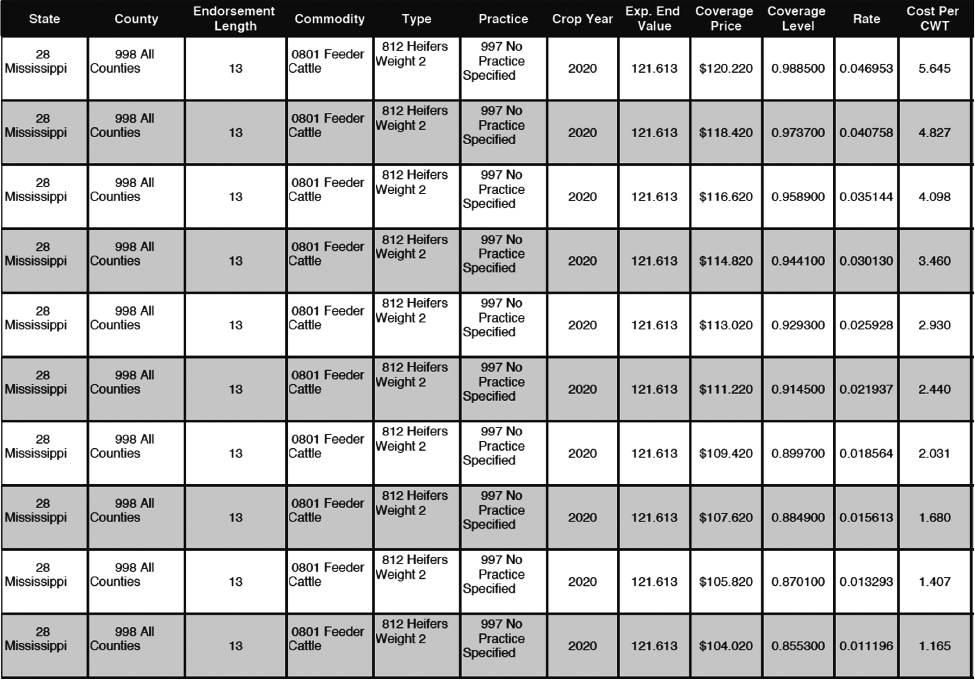

Assume a cattle producer in Mississippi plans on selling 120 heifers in 3 months at a target weight of 750 pounds and owns 100 percent of the cattle. To most closely match the 3-month period, the producer chooses a coverage length of 13 weeks. The expected ending value is $121.61 per hundredweight (this amount has been adjusted 90 percent because the cattle are heifers over 600 pounds). For illustration purposes only, let’s assume this producer chooses the highest available coverage level. As shown in Table 4, the highest available coverage level on this day is 98.85 percent; when this amount is multiplied by the expected ending value, it means the coverage price for this level is $120.22 and the actuarial premium rate is .046953. With this information, the producer can calculate the premium:

Premium Calculation

(1) 120 heifers * 7.5 cwt = 900 cwt (i.e., 90,000 pounds)

(2) 900 cwt * $120.22 coverage price = $108,198 total insured value

(3) $108,198 * 100 percent ownership share = $108,198 total insured value

(4) $108,198 * 0.046953 actuarial rate = $5,080 total premium

(5) $5,080 premium – ($5,080.22 premium * 25 percent subsidy) = $3,810 producer premium

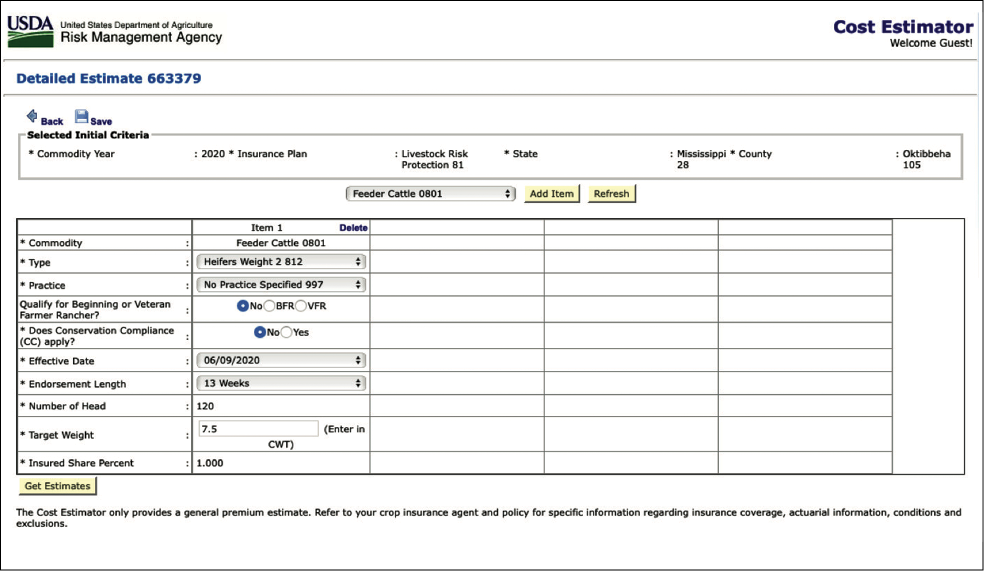

Note that this calculation uses a 25 percent subsidy level to reflect the subsidy increase implemented on July 1, 2020. Before July 1, the premium subsidy for this example would have been 20 percent (Table 1). RMA provides a Premium Cost Estimator online to allow producers the ability to enter their information and get a premium estimate. An example of this calculator is shown in Figure 2 and available online through https://ewebapp.rma.usda.gov/apps/costestimator/.

Indemnity Calculation Scenario 1

For this example of 120 heifers, assume that the CME Feeder Cattle Index is $120 at the end of the 13-week period. Therefore, after multiplying by the 90 percent price adjustment factor, the actual ending value for the heifers is $108.

(1) $120.22 coverage price – $108 actual ending value = $12.22 per cwt difference

(2) $12.22 cwt difference * 120 heifers * 7.5 cwt * 100 percent share = $10,998 indemnity payment

The producer can subtract the paid premium from the indemnity payment to calculate net gain or loss from LRP.

(1) $10,998 indemnity – $3,810 paid premium = $7,188 net gain from LRP

Using the assumption that the actual sales price of the producer’s heifers has declined similarly to the CME feeder cattle index, the net gain from LRP should help to offset the lower price received for the cattle sales.

Indemnity Calculation Scenario 2

In this second scenario, let’s assume the CME Feeder Cattle Index is $135 at the end of the 13-week period. Therefore, after multiplying by the 90 percent price adjustment factor, the actual ending value for the heifers is $121.50, which is higher than the coverage price of $120.22. Because the ending value is higher than the coverage price, the indemnity payment will be $0.

In this example, the producer still must pay the premium of $3,810. Using the assumption that the actual sales price of the producer’s heifers has increased similarly to the CME feeder cattle index, the producer did not face a price loss in this example. Therefore, an indemnity payment is not triggered, and the paid premium can be viewed as the cost of price risk coverage that was ultimately not needed because prices didn’t decline by more than the coverage amount chosen.

Table 4. LRP Coverage Prices, Rates, and Actual Ending Values (Source: USDA, RMA Website)

LRP Advantages

There are some advantages to the LRP program when compared to futures and options as listed in Table 5.

LRP insurance behaves similarly to a put option in protecting the policyholder from downside market risk. It essentially sets a price floor for the producer using the CME feeder cattle index. While it does not guarantee a specific price for the actual cattle sold, it can provide an indemnity payment to the producer to make up for a significant decline in the market. LRP insurance is also relatively easy to access and purchase, and the premiums are subsidized. Additionally, lenders may have more experience with insurance products and may view LRP more favorably than other risk-management strategies.

|

Features |

LRP |

Put option |

Futures contract |

|---|---|---|---|

|

Minimum quantity |

1 head |

50,000 lb |

50,000 lb |

|

Broker required |

No, but crop insurance agent required |

Yes |

Yes |

|

Margin calls |

No |

No |

Yes |

|

Subsidized |

Yes (20–35 pct.) |

No |

No |

LRP Considerations

There are a few potential disadvantages of LRP to consider. First, the CME feeder cattle index may not be perfectly correlated with a producer’s local prices for all classes of cattle. In this case, price fluctuations at the local level may not be fully reflected in CME index fluctuations.

LRP may not work well for cattle weighing significantly less than 600 pounds. This is because cattle are generally worth more per hundredweight at lower weights. While the 110 percent price adjustment factor for steers below 600 pounds is meant to address this issue, cattle weighing significantly less than 600 pounds would likely need an even bigger adjustment factor.

Additionally, an LRP policy can only be exercised at the end of the coverage period. This differs from a put option which can be exercised any time before expiration and is generally more flexible than an LRP policy.

One final point is that not all coverage options are available every day, and sometimes, a producer might have to wait for a number of days in order to get a preferred coverage level or period length.

Conclusion

Because of the protection it provides against cattle market price risk, Livestock Risk Protection insurance could be an effective option for many Mississippi cattle producers. Producers’ management practices and risk preferences are different, and each producer should weigh all of their options. LRP insurance is not meant to increase profits but can help producers offset potential losses due to market declines. The LRP program could be a viable answer for many producers who don’t want to be entirely at the mercy of a volatile market.

Publication 3488 (POD-7-20)

By Shelby Leigh Brewer, Senior in Agribusiness; Josh Maples, PhD, Assistant Professor; and Keith Coble, PhD, Department Head, Department of Agricultural Economics

Copyright 2020 by Mississippi State University. All rights reserved. This publication may be copied and distributed without alteration for nonprofit educational purposes provided that credit is given to the Mississippi State University Extension Service.

Produced by Agricultural Communications.

Mississippi State University is an equal opportunity institution. Discrimination in university employment, programs, or activities based on race, color, ethnicity, sex, pregnancy, religion, national origin, disability, age, sexual orientation, genetic information, status as a U.S. veteran, or any other status protected by applicable law is prohibited. Questions about equal opportunity programs or compliance should be directed to the Office of Compliance and Integrity, 56 Morgan Avenue, P.O. 6044, Mississippi State, MS 39762, (662) 325-5839.

Extension Service of Mississippi State University, cooperating with U.S. Department of Agriculture. Published in furtherance of Acts of Congress, May 8 and June 30, 1914. GARY B. JACKSON, Director

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.