Vol. 10 No. 7 / Dockside and Wholesale Prices of Oysters

U.S. Oyster Landings, Dockside Values, Total Supply, and Wholesale Prices

Abstract

In this issue, Dr. Posadas describes the long-term trends in oyster commercial landings, dockside values, and prices. The total supply, imports and consumption, and wholesale prices of oysters are also illustrated. A simple price model was developed to measure the potential impacts of the current public health crisis on wholesale prices.

Citation:

Posadas, Benedict C. U.S. oyster landings, dockside values, total supply, and wholesale prices. Mississippi MarketMaker Newsletter, Vol. 10, No. 7. July 16, 2020. http://extension.msstate.edu/newsletters/mississippimarke.tmaker.

I love frying, grilling, boiling or baking oysters with all the spices that enhance their flavor. Eating raw oysters is a thing of the past for me, unless post-harvest processed. We gather as a family and friends during holidays in front of dozens of grilled oysters harvested from the Mississippi growing waters. Lately, the retail prices have become prohibitive, and the supply a bit scarce that my oyster consumption is limited in restaurants on certain occasions.

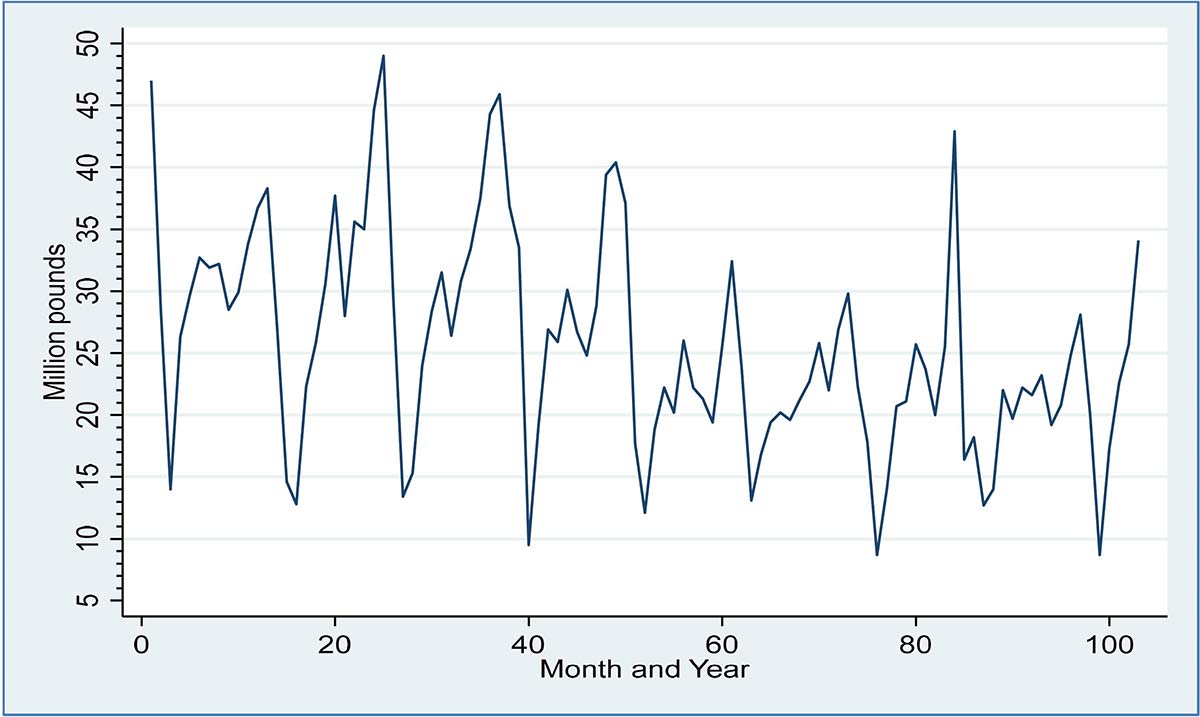

Commercial Landings

The annual commercial landings of oysters in the U.S. were at its peak in the 1950s at around 70 million pounds. Between 1960 and mid- 1980s, landings hovered below 50 million pounds. Since 1990, the annual U.S. oyster landings stayed below 30 million pounds. The primary species harvested were Eastern and Pacific oysters.

Figure 1 shows the yearly commercial landings of oysters in the entire U.S. from NOAA Fisheries at http://www.st.nmfs.noaa.gov/.

Landing Values

The annual landing values of oysters were generally flat at $25 million between 1950 and 1970 and consisted mostly of Eastern oysters. Until 1980, landing values continued to climb to $75 million. Most of these values were from Eastern oysters and the increasing share of Pacific oysters. After 1980 until 2010, total landing values stayed around $75 million. The contribution of the Eastern oysters started to shrink while that of the Pacific oysters was continuously expanding. After 2010 up to the present, total oyster landing values continued to rise up to more than $200 million. Increases in both the Eastern and Pacific landing values were observed during the past decade.

Dockside Prices

Oyster dockside prices continued to increase primarily due to almost stagnant if not declining domestic landings. The rapid increases in dockside prices occurred starting in 2000 when prices were around $3 per pound for Pacific oysters and over $2 per pound for Eastern oysters. Almost a decade later, prices rose to $7 per pound and almost 8 per pound for Pacific and Eastern oysters, respectively.

Total Supply

NOAA Fisheries computes the total supply of oysters as the sum of domestic landings plus imports less exports. The total supply of oysters since 2011 averaged 63.4 million pounds with 5.3 million pounds deviation.

The apparent per capita consumption of oysters is estimated by dividing the total supply by the civilian population. The overall trend in per capita oyster consumption is downward sloping. It stood at about 0.24 pounds in 1990, 0.23 pounds in 2000, 0.21 in 2010, and 0.20 in 2018. The decline in oyster consumption is attributable to the continued fall in domestic landings.

Total Imports

Total net imports are computed from total imports, less total exports. Since 2011, total imports averaged 36.7 million pounds with 7.6 million pounds deviation. On the other hand, total exports averaged 6.8 million pounds with 0.9 million pounds deviation. Consequently, total net imports averaged 29.9 million pounds with 6.9 million pounds deviation.

The share of total imports to the total supply of oysters is on the rise. Before 2003, the percent of imports was at or below 50 percent. After that year, imports dominated the total oyster supply. Since 2011, 57.4 percent of the total supply was imported. By 2018, imports consisted of 70 percent of total oyster supply.

In 2018, total imports reached 49.8 million pounds. Live/fresh farmed oysters were the leading import with 9.8 million pounds. The major exporting countries of live/fresh oysters were Canada (47.3%), South Korea (43.7%), Hongkong (5.4%), and Japan (3.7%)

Smoked canned oysters came in second leading import with 9.4 million pounds. This product was imported from China (89.3%), South Kores (10.7%), and Canada (<1%).

The third most imported product was canned oysters with 5.8 million pounds. The leading exporting countries were China (58.3%), South Korea (39.1%), and Japan (2.7%).

Imports of frozen farmed oysters totaled 2.6 million pounds. They mostly came from South Korea (74.3%), Hong Kong (12.1%), Japan (8.8%), Canada (4.5%), Mexico (0.2%), and New Zealand (0.1%).

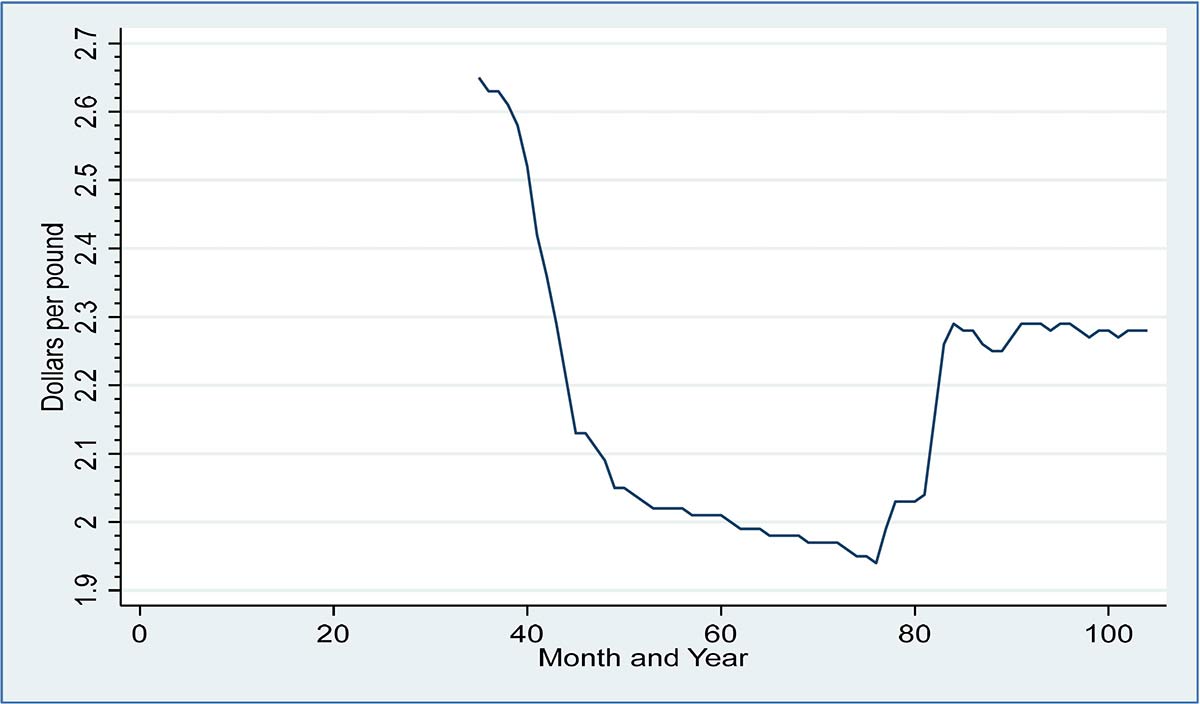

Wholesale Prices

The wholesale selling prices of oysters by meat count were compiled from proprietary data reported by Urner Barry Comtell. Only summaries of the wholesale prices were presented in this issue. Three oyster meat counts traded in the Mid-Atlantic wholesale markets sold year-round are presented below. Differences in the benchmark prices (2014-18), 2019 and 2020 (Jan-Jul) were observed in the three different oyster meat counts sold in the wholesale markets as follows:

- Extra-Select oysters, wholesale prices were $92, 96 and 90 per gallon.

- Select oysters, wholesale prices were $90, 94 and 88 per gallon.

- Standard oysters, wholesale prices were $89, 94 and 88 per gallon.

Price Impacts

The price impacts were computed from the 2019 and 2020 average wholesale prices as compared to the average 2014-18 benchmark prices. The 2019 wholesale prices rose by 4.93%, 4.95%, and 6.6% over the benchmark prices for the X-Select, Select, and Standard oysters, respectively. This upward movements in wholesale prices were primarily attributable to widespread shortages in domestic landings.

In Jan-Jul 2020, the average wholesale prices for X-Select, Select, and Standard oysters fell by 2%, 1.82%, and 0.27%, respectively. The most likely explanation to these downward trends in prices is the rapid decline in domestic demand by large institutional buyers due to the mandatory closure of their business operations arising from the ongoing public health crisis.

MarketMaker Seafood Businesses

State and federal guidelines regulate oyster harvesting. Monthly landings data in the Gulf of Mexico states in 2016 showed that Eastern oysters are available year-round.

More than 12,000 businesses that catch, process, and sell seafood products are registered in MarketMaker nationwide. There are more than 200 businesses that promote their seafood products and services in Mississippi MarketMaker. To search for seafood businesses in MarketMaker, perform the following procedures:

- Go to https://ms.foodmarketmaker.com/main/mmsearch/

- Click “search” and type “Fish/Seafood/Shellfish” in the product box.

- You can sort the search results by relevance and name.

- You can also limit online searches by state and type of business

My Oyster Publications

- Posadas, Benedict C. 2019. Economic Impacts of Coastal Hazards on Mississippi Commercial Oyster Fishery from 2005 to 2016. Journal of Ocean and Coastal Economics. Journal of Ocean and Coastal Economics, 6(1), 27.

- Posadas, Benedict C. 2019. Commercial Oyster Fishery Impacts of the Protracted Opening of the Bonnet Carre Spillway. Horticulture and Marine Economics Blog.

- Posadas, Benedict C. 2019. Commercial Oyster Fishing. Mississippi MarketMaker Newsletter, Vol. 9, No. 6.

- Posadas, Benedict C., and Benedict Kit A. Posadas, Jr. 2017. Economic Impacts of the Opening of the Bonnet Carre Spillway to the Mississippi Oyster Fishery. Journal of Food Distribution Society, 48(1). 42-45.

- Posadas, Benedict C., and Benedict Kit A. Posadas, Jr. 2017. Economic Impacts of the Opening of the Bonnet Carre Spillway to the Mississippi Oyster Fishery. Mississippi State University Extension Service publication 2846 and Mississippi-Alabama Sea Grant publication MASGP-11-041. Mississippi State, Mississippi.

- Posadas, Benedict C., Ruth A. Posadas, and Linda S. Andrews. 2011. Consumer Preferences for Postharvest Processed Raw Oyster Products in Southern California. Mississippi Agricultural and Forestry Experiment Station Bulletin 1194, Mississippi State, Mississippi.

- Posadas, Benedict C., and Ruth A. Posadas. 2011. Consumer Preferences for Postharvest Processed Raw Oyster Products in Coastal Mississippi. Mississippi Agricultural and Forestry Experiment Station Bulletin 1192, Mississippi State, Mississippi.

- Posadas, Benedict C., Linda S. Andrews, and Susan T. DeBlanc. 2011. Consumer Preferences for Irradiated Oysters. Mississippi Agricultural and Forestry Experiment Station Bulletin 1193, Mississippi State, Mississippi.

- Posadas, Benedict C. Economic Alternatives for Gulf of Mexico Oyster Processing Sector. 2010. Proceedings of the Special Symposium: Setting the Agenda for Food Marketing and Economics Research. Food Distribution Research Society.