Legal Forms of Farm Business Organization: Which Should I Choose?

The U.S. agricultural sector is constantly evolving in organizational complexity and size. Given new operational and financial opportunities with varying risk levels, the composition of different legal forms for U.S. farms has also changed over the years. A farm business can be structured in multiple ways, with sole proprietorship farms being the most popular form of business. While sole proprietorship represented more than 90 percent of farms a decade ago, that percentage has decreased as more farmers switch their business model to partnerships, limited liability companies (LLCs), and corporations. This shift indicates that farmers are reacting to industry changes by restructuring their business forms. The legal form of farm business organization has a significant impact on generating and conserving the income from the business, managerial authority, business liabilities, and record-keeping responsibilities.

This publication examines the implications of different legal forms of business concerning the ownership structure, liabilities, and taxation. It also outlines the necessary steps to form each type of business in Mississippi. With varying implications of business structures, a farm business owner should choose the best option for long-term benefit. The following criteria can help in determining which legal form is ideal for your farm business.

Evaluation Criteria

Control and Liabilities

There is usually a trade-off between the liabilities and control over the farm business. Choosing a business structure that ensures unlimited control for the owners/managers usually results in the full liability of the owner. Full liability or unlimited liability means that the owner/partner/member is personally liable for all business obligations. In the case of farm insolvency or bankruptcy, the farmer takes full liability on the business debts, and personal assets become subject to seizure by debtors or creditors.

A business where there is a separation between business obligations and personal assets and liabilities is called a limited liability business. While running such a business provides some protection, this option will likely result in the loss of managerial control.

Need for Capital and Ownership Structure

The need for financial capital is one of the biggest drivers of switching a business structure from a sole proprietorship. A farm business run by a single person or family typically faces financial capital constraints. Even if a farm business has the potential to grow, a lack of capital can limit the growth. Banks are more reluctant to lend to a business where there is only one owner due to the higher risk.

One way to overcome capital constraints is to share the ownership of the business. Having multiple owners can inject additional equity capital into the business and borrowing from banks can be easier. However, a business with multiple owners means the managerial control is divided.

Taxation

Different types of organizations have different taxation rules on business income taxes, personal income taxes, and social security taxes. Farm businesses that operate as sole proprietorships, partnerships, or LLCs all pay taxes on business profits in the same way. These business types are “pass-through” tax entities, meaning that all of the profits and losses of the business pass through to the owners, who report their share of the profits (or deduct their share of the losses) on their income tax returns.

Owners of these businesses must pay income taxes on all net profits of the business, regardless of how much they take out of the business each year. The business itself does not pay income tax. Corporate farms (C corporation), however, are different in that they may face double taxation where the corporation pays tax on corporate profits and the owner (shareholder or stockholder) pays tax on dividends.

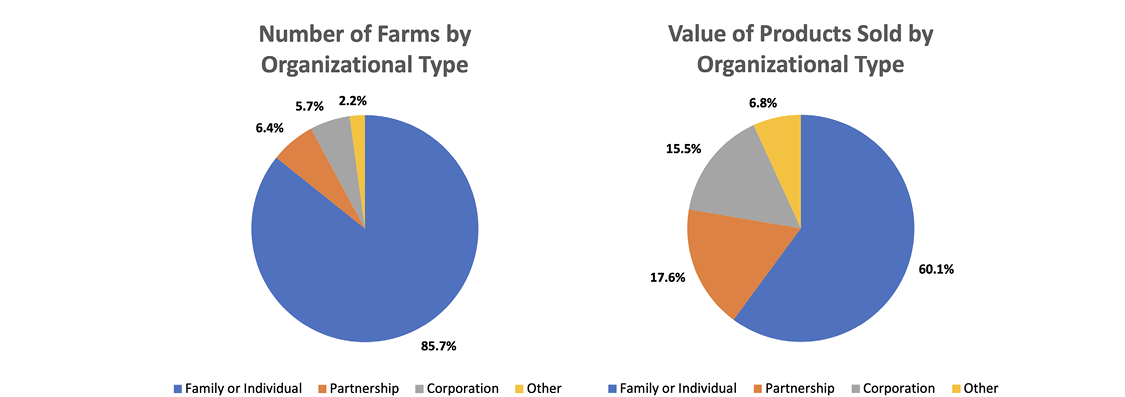

Sole Proprietorship

Most farmers in the United States operate their farms in the form of a sole proprietorship. This is a business structure with one owner– a single person or a family. Sole proprietorship farms are easy to set up and guarantee full control of the farm business to the owner. According to the 2017 Census of Agriculture, 85.8 percent of U.S. farms were sole proprietorships, and the value of agricultural products sold by sole proprietorship farms represents 60.1 percent of total sales, making sole proprietorship farms the largest business structure in the agricultural sector. Since its peak in 2007, the percentage of sole proprietorship farms has consistently decreased as more farms switch to other business forms.

In Mississippi, one can establish a sole proprietorship without filing any legal documents with state government. However, the entity is required to obtain an Employer Identification Number (EIN) from the IRS if the business hires employees.

Keywords: Single owner; Full control; Unlimited liabilities; Pass-through taxes

Management and Control

Under this business structure, the management control is maximized, and the administrative costs are minimized. The owner (proprietor) has unlimited control over the farm business decisions. Documents other than income tax filings, employee withholdings, and workers’ compensation reports are not required by law, making sole proprietorship the easiest business structure to establish.

Financing

The capital of sole proprietorship is limited to the owner’s wealth, and borrowing from lending institutions can be limited. Retained earnings from the previous year’s business are an important source of new capital. The capacity and resources of the owner may limit the growth of the underlying business, since the single owner must secure capital on his own to grow the business. The proprietor can raise additional capital by borrowing from lending institutions or by sharing the ownership with others, while the latter requires a change of legal form of the business.

Liabilities

The owner takes unlimited liability for the business. While the proprietor has the maximum management control, this also means that there is no separation between the farm business and the proprietor. In case of insolvency or bankruptcy of the business, the proprietor’s assets, such as personal cars or dwellings, can be seized by creditors. This can pose a significant risk to the owner’s personal assets or holdings.

Transfer of Ownership

Another disadvantage of a sole proprietorship is the difficulty of the transfer of ownership. Ownership transfer can be difficult for a sole proprietorship, as the ownership transfer requires the sale of the entire business to a new owner, since partial transfer is not possible.

Taxation

Farm business income passes through the business to the proprietor. The proprietor is taxed on all profits whether or not the income is withdrawn from the business because there is no separation between the business and the person. Social security taxes are based on before-tax net income, so they are not a deductible expense for income tax purposes for proprietorship. A sole proprietorship can apply for a pass-through tax deduction of 20 percent under the Tax Cuts and Jobs Act (TCJA), which expires in 2026.

General Partnership

The partnership is another popular structure for a farm business. In a partnership farm, there are two or more owners or partners. Parent-child partnerships have become a popular form of business organization in U.S. agriculture, and this can result in lower taxation amounts because income allocated to each partner will put them into a lower tax bracket. According to the 2017 Census, 6.4 percent of U.S. farms were partnership farms, which remains relatively unchanged compared to the 6.1 percent reported in the 2012 Census. The value of agricultural products sold by partnership farms represents 17.6 percent, making partnerships the second largest business form in numbers and in sales.

The main benefit of partnerships is that additional capital can be injected into the underlying business by having multiple owners (partners). Thus, if a sole proprietor faces financial constraints but wants to grow the size of the business, establishing a partnership can relax the financial constraint because it will inject new capital or the wealth of other owners.

Depending on the partnership structure, partnerships can be categorized as general partnerships or limited partnerships. A general partnership is the dominant form of partnership in U.S. farm businesses. General partners are personally liable for all business debts and business liabilities incurred by other partners.

There is no need to file any organizational documents with the state government when creating a general partnership. However, it is strongly encouraged to have a written partnership agreement among partners to specify rules for possible disputes. Obtaining an EIN from the IRS is required if the business hires employees.

Keywords: Multiple owners (partners); Full control; Unlimited liabilities; Pass-through taxes

Management and Control

In a general partnership, all general partners share management equally based on the specified shares of each partner. Each partner has the power to bind the partnership. A general partnership can be organized with or without a written agreement or contract. However, it is strongly encouraged to have a written agreement among partners. Compared to sole proprietorship, recordkeeping is more important for taxation purposes.

Financing

With multiple partners, each individual can bring their equity capital which becomes the source of financing. Banks are likely to lend more to a general partnership than a sole proprietorship because the risk is shared among multiple partners. More partners can enter the general partnership, but this will result in the reduced control of existing partners.

Liabilities

Liability of the business, similar to sole-proprietorship, extends to the total assets of all partners for obligations of the farm and actions of other partners. If the partnership becomes insolvent, each partner’s assets become subject to seizure.

Transfer of Ownership

General partnerships can be dissolved by any partner. While the death of a partner tends to result in the end of general partnerships, this does not have to be the case. However, it is usually difficult to plan for continuity of partnership business beyond the first generation. Title to actual resources of partners must be transferred.

Taxation

Partnership (business) itself does not pay income taxes like a proprietorship. All farm profits and losses are allocated to partners. A partnership is a pass-through entity, and the tax obligation of the business is not separate from its owners. Salaries paid to general partners are taxable to the recipients and are a deductible expense to the partnership. A general partnership can also apply for a pass-through tax deduction under the TCJA.

Limited Partnership

Similar to general partnerships, the main goal of a limited partnership is to bring in additional financial capital. While there are only general partners in a general partnership, there are two different types of partners in a limited partnership: general partners and limited partners. General partners and limited partners differ in terms of managerial control and business liabilities. The main driver of such separation between general partners and limited partners is to inject financial capital from limited partners without diluting the general partners’ managerial control.

To form a limited partnership in Mississippi, businesses are required to file a Certificate of Limited Partnership on the Mississippi Business Services website. Writing the certificate will require formal agreement among partners. Obtaining an EIN from the IRS is required if the business hires employees.

Keywords: Multiple owners (partners); Full Control and Unlimited Liabilities (general partners only); Limited Control and Limited Liabilities (limited partners only); Pass-through Taxes

Management and Control

In limited partnerships, only the general partners run the farm business and managerial control is divided among general partners. Limited partners have limited to no managerial responsibility. Limited partnerships may be structured so that the farming family members are general partners and off-farm partners are limited partners. In some situations, the limited partnership is used to hold the land, which is then rented to the general partner. A limited partnership is required to provide reports to limited partners.

Financing

While general partners may supply financial capital to the underlying business, they can face financial constraints in the future. Limited partnerships are designed to attract financing from limited partners who would endow their money to general partners. This structure enables general partners to obtain additional capital from limited partners while not giving up their managerial control over the underlying business.

Liabilities

General partners are liable for business debts and obligations, and in case of farm bankruptcy, general partners’ personal assets can be seized by creditors. Limited partners have limited liabilities, and their liability is limited to the dollar amount invested in the partnerships. Thus, while limited partners may benefit the underlying business, they get liability protection.

Transfer of Ownership

General partnerships can be dissolved by a general partner. While the death of a general partner tends to result in the end of general partnerships, this does not have to be the case. Transfer of limited partner’s interest is allowed as long as the general partner consents to the arrangement, and it is done in concert with the established partnership agreement.

Taxation

Partnership (business) itself does not pay income taxes. All farm profits and losses are allocated to partners. A limited partnership is a pass-through entity and the tax obligation of the business is not separate from its owners. Salaries paid to general partners are taxable to the recipients and are a deductible expense to the partnership. A limited partnership can also apply for a pass-through tax deduction under the TCJA.

Limited Liability Company (LLC)

A limited liability company is a recent form of business that combines the benefits of partnership and corporations. Limited liability companies provide liability protection for the owners similar to corporations, while the pass-through taxation structure resembles that of sole proprietorship or partnerships. Due to its benefits, the number of LLC farms has significantly increased in past years. The 2017 Census data shows that 6.7 percent of U.S. farms are operating as LLCs.

Profits and losses can get passed through to your income without facing corporate taxes. However, members of an LLC are considered self-employed and must pay self-employment tax contributions toward Medicare and Social Security.

To form an LLC in Mississippi, you must file the articles of organization with the Mississippi Secretary of State. It is also required to have the words “Limited Liability Company or “LLC” in the business name. The articles include the designation of management, governance arrangements, compensation, dissolution conditions, and the rights and responsibilities of members. The certificate of formation will also require the identification of the line of business using the North American Industry Classification System (NAICS) code, and for farm businesses, the NAICS code should start with 11. You will also need to appoint a registered agent in Mississippi for the service. In addition, while not required by law, you also should prepare an operating agreement to establish the basic rules about how your LLC will operate. The operating agreement is not filed with the state.

Keywords: Flexible number of owners (members); Full Control and Unlimited Liabilities (general partners only); Limited Liabilities; Pass-through Taxes

Management and Control

An LLC’s owners can be individuals, partnerships, corporations, or even other LLCs. The owners are often called members. An LLC can be a single-member or multi-member entity, and such flexibility enables even a sole proprietorship farm business to change to an LLC. If there are multiple members in an LLC, an LLC’s certificate of formation and operating agreement identify the member’s percentage interests in the LLC. This will be the basis of the member’s rights and responsibilities and voting powers. Profits and losses are also based on the percentage of interests.

All corporations operating in Mississippi must file an annual report with the Mississippi Secretary of state, between January 1st and April 15th of each year.

Financing

Means to raise financial capital for an LLC are similar to partnerships. An LLC can take loans from lending institutions, or introduce new members who will inject equity capital. Limited partnerships are designed to attract financing from individuals who would endow their money to general partners. In turn, the general partners will run the business.

Liabilities

The members of an LLC have limited liabilities, as they can sign personal guarantees as a means of raising additional capital. With limited liabilities, a member receives protection in case of bankruptcy or insolvency of the LLC.

Transfer of Ownership

Member’s transfer of ownership is dictated by the agreement as outlined in the operation agreement. It is strongly encouraged for the operation agreement to include a section about the buy-sell agreement, outlining the rules on the transfer of ownership can be specified. The agreement should also address how the business and its membership interests will be valued in the case of interest transfer.

Taxation

Depending on the elections made by the LLC and the number of members, an LLC can be treated as a corporation, partnership, or sole-proprietorship. An LLC with at least two members is classified as a partnership for federal income tax purposes, unless it files Form 8832 and affirmatively elects to be treated as a corporation. An LLC is a pass-through entity, meaning that the business’s tax obligation is not separate from its owners. An LLC can also apply for a pass-through tax deduction under the TCJA.

Corporation

A corporation is a legal entity recognized by private and public law as a legal person in a legal context. It is the most complex form of business organization, where the owners are often called shareholders or stockholders. Stocks or shares are units of equity ownership in a corporation. Corporations operate by a set of rules called bylaws, which are drafted by the company and adopted by the shareholders. Bylaws are not filed with the state, but they are required by statute. Corporation farms are the largest farms in the United States. According to the 2017 Census, corporation farms represent 5.7 percent of total farms. Due to the scale, the value of the agricultural product sold from corporation farms represents 15. 5 percent of total sales.

There are two types of corporations: C corporations and S corporations. Both options share limited liability, issuance of stocks, and reserving a board of directors, but there are differences in the maximum number of shareholders and taxation. To form a S corporation, the business must meet the following criteria:

- The business has only one class of stock outstanding.

- There cannot be more than 100 shareholders.

- All shareholders consent to the choice of forming a S corporation.

The S corporation is suitable for small businesses, including those in agriculture. To form a corporation in Mississippi, you need to prepare articles of incorporation with the Secretary of State. For the articles of incorporation, several items must be specified. These include:

- Name of the corporation

- Names and addresses of incorporators and directors

- Name of a Registered Agent and registered office

- Stock structure

In the articles of incorporation, at least one incorporator must be specified. The person or entity that signs and files the articles of incorporation is called an incorporator. There can be one or more incorporators, and an incorporator does not have to be a shareholder or a state resident. However, the name and address of the incorporator must be specified.

Additionally, at least one director of the corporation must be specified in the articles of incorporation. Directors of a corporation oversee the business on behalf of the shareholders, and are in charge of the adoption, amendment, and repeal of bylaws. They also supervise, elect, and remove top officers.

Similar to LLC, the articles of incorporation must specify a registered agent, which is a person or entity that accepts tax documents and service of process on behalf of the corporation.

The articles must list every class of shares or series within a class and the total number of shares authorized in each. If there will be more than one class of shares, the articles must describe the rights and limitations of each class.

Keywords: Shareholders (A large number of owners); Limited liabilities; Double-taxation (C corporation only)

Management and Control

Shareholders are the owners of a corporation and shareholders with higher shares exercise greater control over the business. Managers of a corporation are able to hold shares of the underlying business. Because shareholders cannot oversee the activities of managers on a frequent basis, shareholders elect a board of directors that appoints and oversees managers on their behalf. With fewer shareholders in a S corporation, there usually is a close link among shareholders, directors, and managers. Corporate earnings may be distributed to shareholders based on the number of shares.

All corporations operating in Mississippi must file an annual report with the Mississippi Secretary of state, between January 1st and April 15th of each year.

Financing

A corporation raises equity capital through selling stocks or through retained earnings. Issuing new additional shares may result in the reduced ownership of the existing shareholders.

Liabilities

The owners of a corporation have limited liabilities, and thus the owners hold no personal liability. With limited liabilities, a member receives protection in case of bankruptcy or insolvency of the corporation.

Transfer of Ownership

Transfer of ownership occurs with the buying-selling of shares. Compared to other forms of businesses, the transfer of corporate ownership is the easiest and the partial transfer of ownership usually does not result in abrupt changes in business management.

Taxation

For shareholders of a S corporation, all profits are allocated to the shareholders for income tax accounting, similar to the taxation rules of a partnership. A C corporation shareholder pays taxes only on the cash dividends received. A C corporation shareholder is thus subject to double-taxation because a corporation pays corporate tax before distributing dividends.

Useful Links and References

Barry, P. J., & Ellinger, P. N. 2012. Financial Management in Agriculture. Prentice Hall.

Mississippi Secretary of State: www.sos.ms.gov

Mississippi Business Services Division: https://corp.sos.ms.gov/corp/portal/c/page/corpNewFilings/portal.aspx

Small Business Administration: https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 3851 (POD-01-23)

By Kevin Kim, PhD, Assistant Professor, Department of Agricultural Economics, and Brian Mills, PhD, Assistant Professor, Delta Research and Extension Center.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.