Vol. 10 No. 9 / U.S. Tilapia Consumption, Production, Imports, and Prices

Abstract

This issue describes the long-term trends in tilapia supply and consumption, production and imports and farm-gate, retail, and wholesale prices. Simple economic models were developed to measure the potential impacts of the COVID-19 pandemic on imports, retail, and wholesale prices. In 2020, the global pandemic disrupted sales to seafood restaurants and other foodservice venues, which purchased about 70 percent of fishery products. Domestic production, processing demand, and imports of tilapia are disrupted by the severe decline in purchases by seafood restaurants and other foodservice businesses. Tilapia prices and expenditures are expected to rise or fall over the years, from warm to cold months, from the changing level of imports, and during the COVID-19 pandemic.

Suggested citation:

Posadas, Benedict C. U.S. Tilapia Consumption, Production, Imports, and Prices. Mississippi MarketMaker Newsletter, Vol. 10, No. 9. September 30, 2020.

Economic Impacts of the Global Pandemic on Seafood Sales

The COVID-19 pandemic was declared a national emergency in the U.S. on March 13, 2020. With the severe disruptions in seafood sales to eating and dining places, producers are forced to hold inventory longer subject to storage capacity and costs, cut back if not shut-down operations, or develop ways to sell directly to consumers. Globally, restaurants will lose 25 to 30 percent of total restaurant sales as compared to 2019 (Seafood Source, 2020). U.S. consumers spent an estimated $102.2 billion on fishery products in 2017, including $69.6 billion at restaurants and other foodservice venues and $32.5 billion at retail. (Intrafish, 2020). U.S. restaurants had sales of $450 billion during the 12 months ending in January. Just over 48 percent of this is from off-premise dining, such as takeout or delivery (Intrafish, 2020). Recently, it was projected that 35 percent of U.S. restaurant purchases evaporate in 2020 (Seafood News, 2020). During this global pandemic, consumers eat more meals at home, indicating that they are making more regular trips to the grocery stores. Consequently, the rush in consumer purchases in retail establishments will push demand higher and jack up retail prices.

Economic Model

This economic analysis attempts to measure the direct economic impacts of the COVID-19 pandemic on the tilapia imports and retail, wholesale prices. Economic models explaining prices and expenditures on imports were estimated using ordinary least squares regression. The dependent variables are tilapia prices and spending on tilapia imports. The independent variables are time, month, total imports, prices of other products, the dollar index, and COVID-19.

The primary sources of data used in the analysis are as follows:

- The annual production data were retrieved from FAO-FISHSTAT (http://www.fao.org/fishery/en).

- The weekly retail and monthly wholesale prices and monthly imports were compiled from Urner Barry Comtell (https://www.comtell.com/).

- The import data were downloaded from NOAA Fisheries Foreign Fishery Trade Data (https://www.fisheries.noaa.gov/national/sustainable-fisheries/foreign-fishery-trade-data).

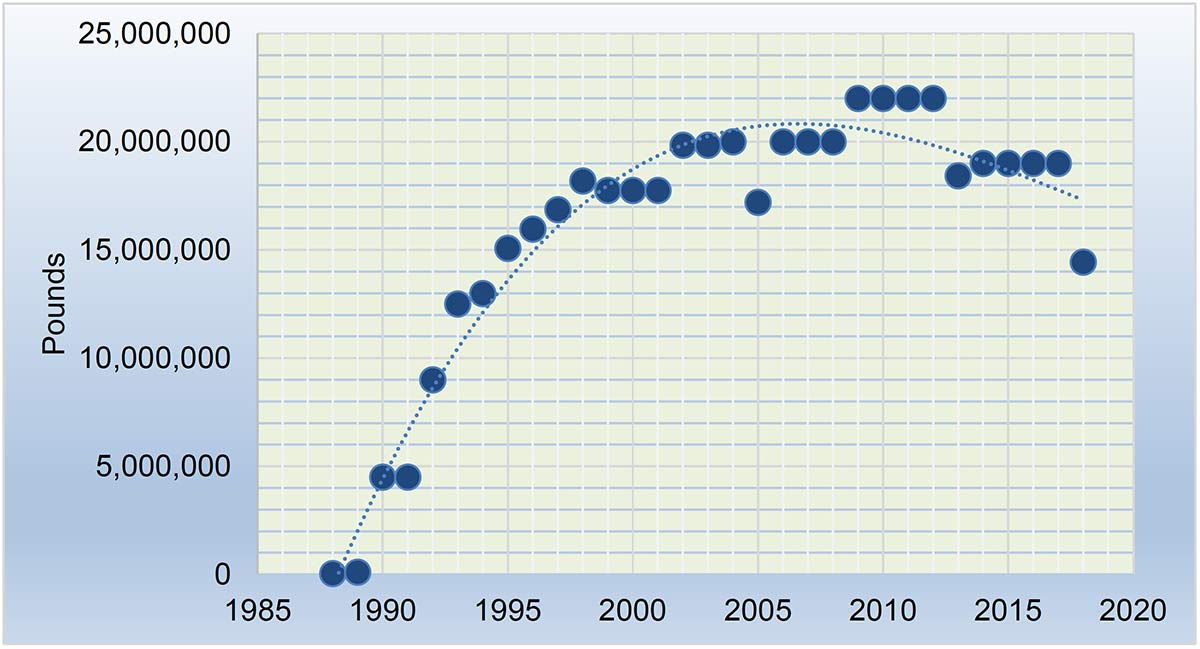

Annual Production and Farmgate Values

A recent survey of aquaculture operations conducted by Virginia Tech Seafood AREC and The Ohio State University Extension indicated that COVID-19 impacted 8 out of 10 tilapia farms. Almost 80 percent have had orders or contracts canceled. Nearly half will soon lay off workers. Almost 70 percent have experienced lost sales. About half can not maintain operations without external help. These initial findings point to the direction the domestic tilapia industry is heading shortly. The declining domestic production will be further exacerbated by the complete or partial shut-down of some fish-farming operations due to the prolonged global pandemic.

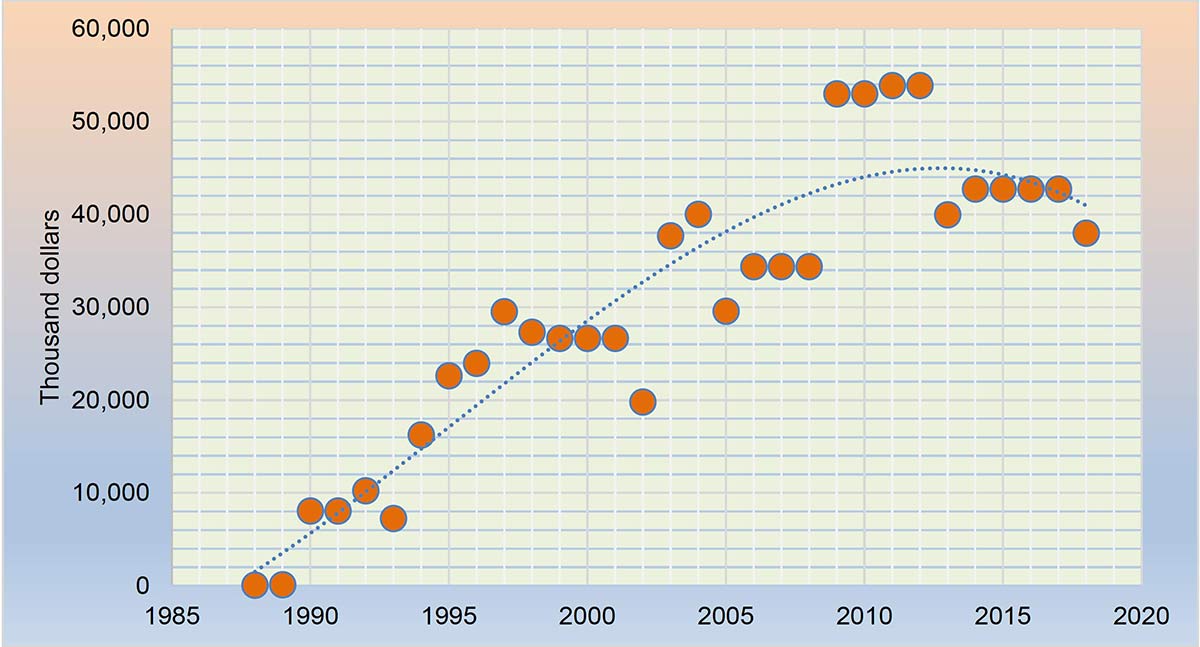

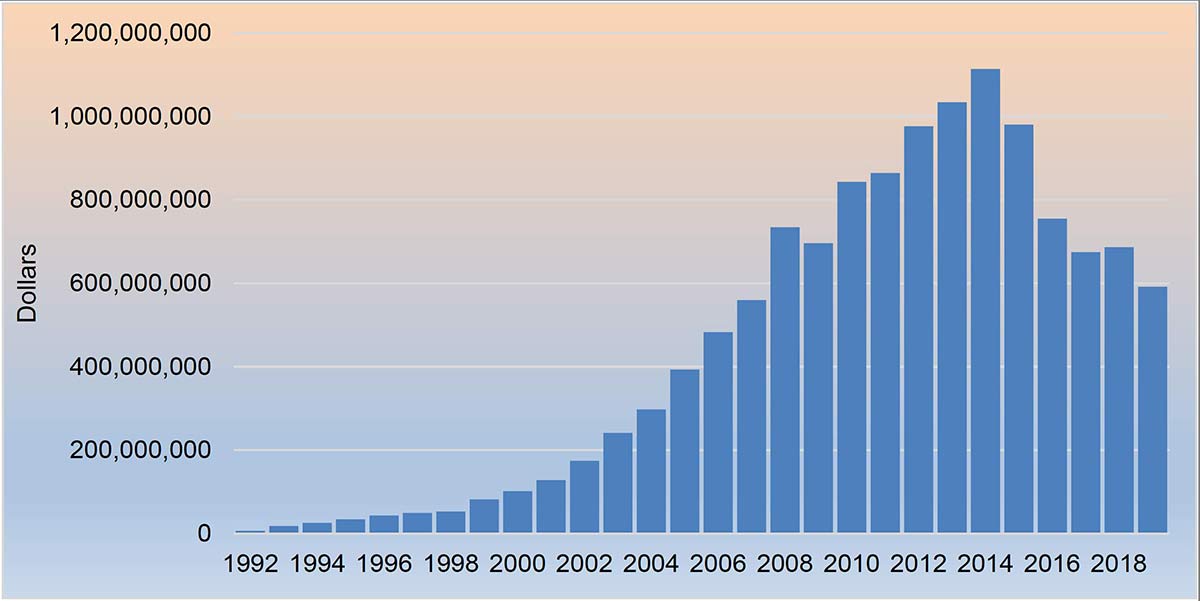

Volume and Expenditure on Tilapia Imports

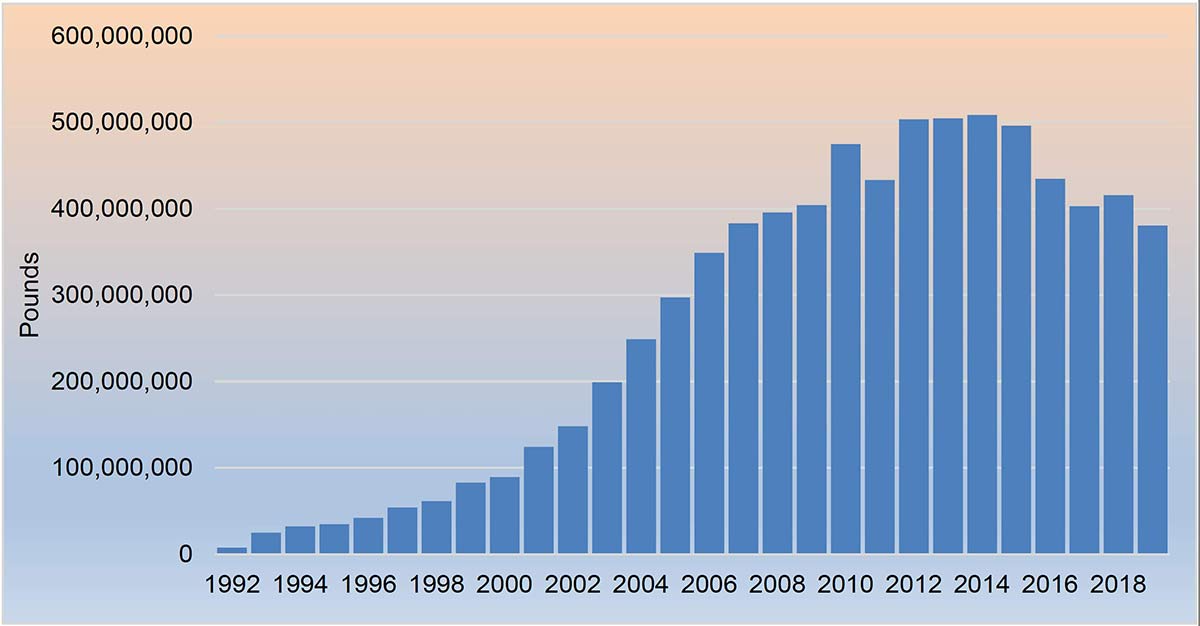

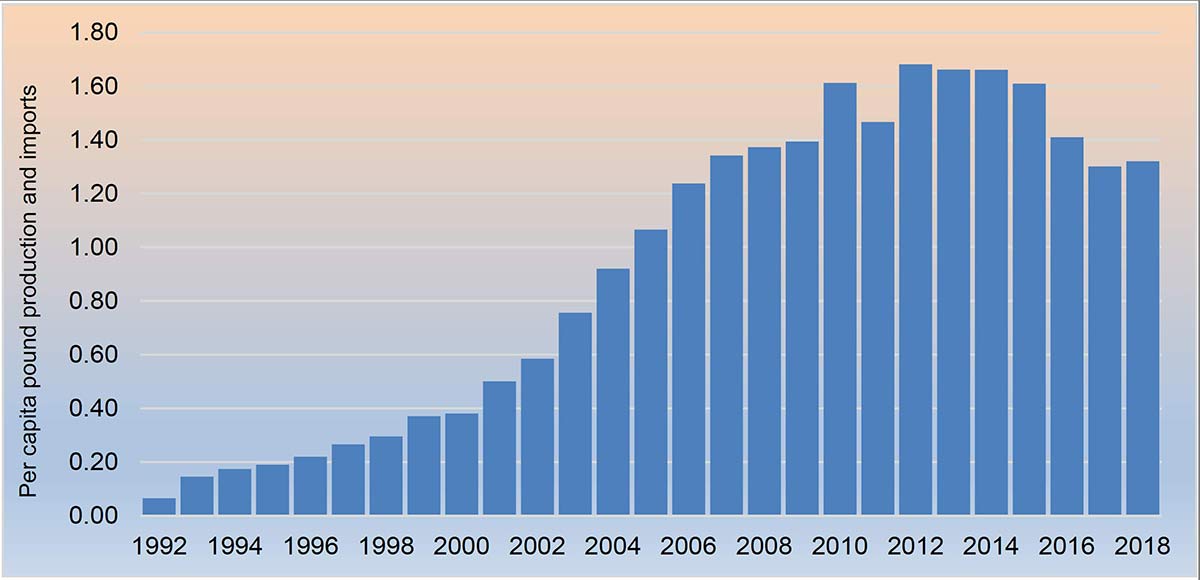

Supply and Consumption of Tilapia

The total supply of tilapia, which is the sum of total production, and total imports, reached its peak in 2012-14 at 525 million pounds, valued at $1.1 billion. After that, it had been downhill up to the present. Both domestic production and imports of tilapia had been decreasing during recent years.

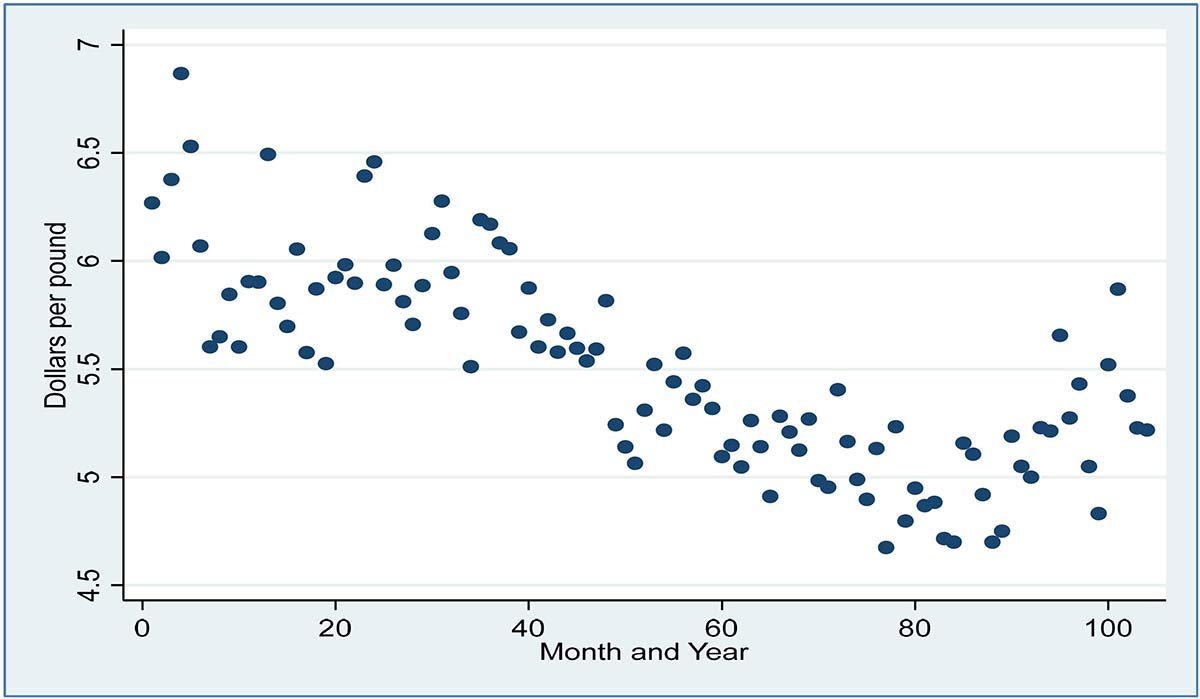

Direct Impacts on Retail Prices of Fresh or Frozen Tilapia Fillets

The estimated regression equation explained 73 percent of the variations in retail prices of fresh/frozen tilapia fillets. The detailed results of the regression analysis are not presented here. Only the significant effects of explanatory variables, especially time, months, and COVID-19, are summarized. The equation used in Stata-16 to measure the direct impacts of COVID-19 on retail prices of fresh or frozen tilapia fillets is as follows:

regress retailprice2 time timesq i.feb i.mar i.apr i.may i.jun i.jul i.aug

i.sep i.oct i.nov i.dec freshmil frozenmil wholemil dtwex i.covid19, vce(r)

The time variable starts in January 2012 and ends in September 2020. Time and months exerted negative but insignificant impacts on retail prices. Fresh and frozen tilapia fillets and frozen whole tilapia imports did not significantly affect retail tilapia prices. Tilapia fillets retail prices were considerably higher during COVID-19 months.

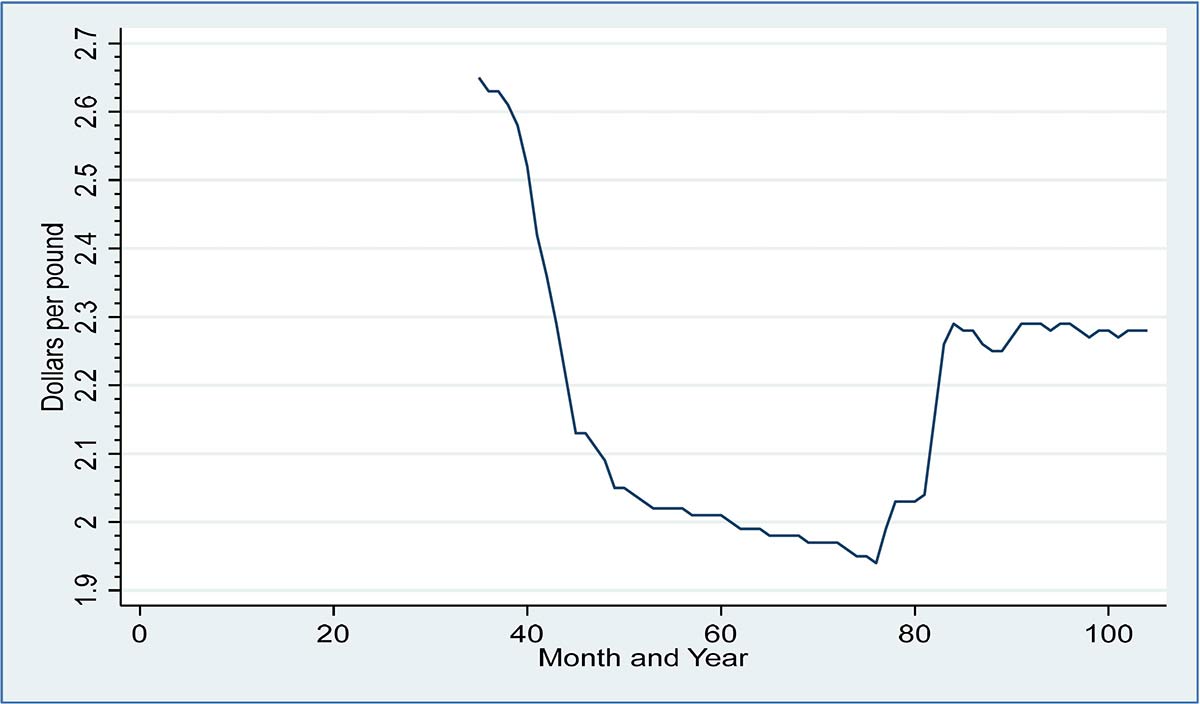

Direct Impacts on Wholesale Prices of Fresh Tilapia Fillets (3-5 Oz) from Central and South America

The estimated regression equation explained 95 percent of the variations in fresh tilapia fillet wholesale prices. The detailed results of the regression analysis are not presented here. Only the significant effects of explanatory variables, especially time, months, and COVID-19, are summarized. The equation used in Stata-16 to measure the direct impacts of COVID-19 on wholesale prices of fresh tilapia fillets is as follows:

regress fresh352 time timesq i.feb i.mar i.apr i.may i.jun i.jul i.aug

i.sep i.oct i.nov i.dec totalmil frozen352 dtwex i.covid19, vce(r)

Regression results confirmed a significant decline over the years of the wholesale prices of imported 3-5 oz fresh tilapia. The wholesale price of 3-5 oz frozen tilapia fillet significantly affected 3-5 oz fresh tilapia fillet wholesale price. The COVID-19 pandemic was exerting a little downward push on the 3-5 oz fresh tilapia fillet wholesale price.

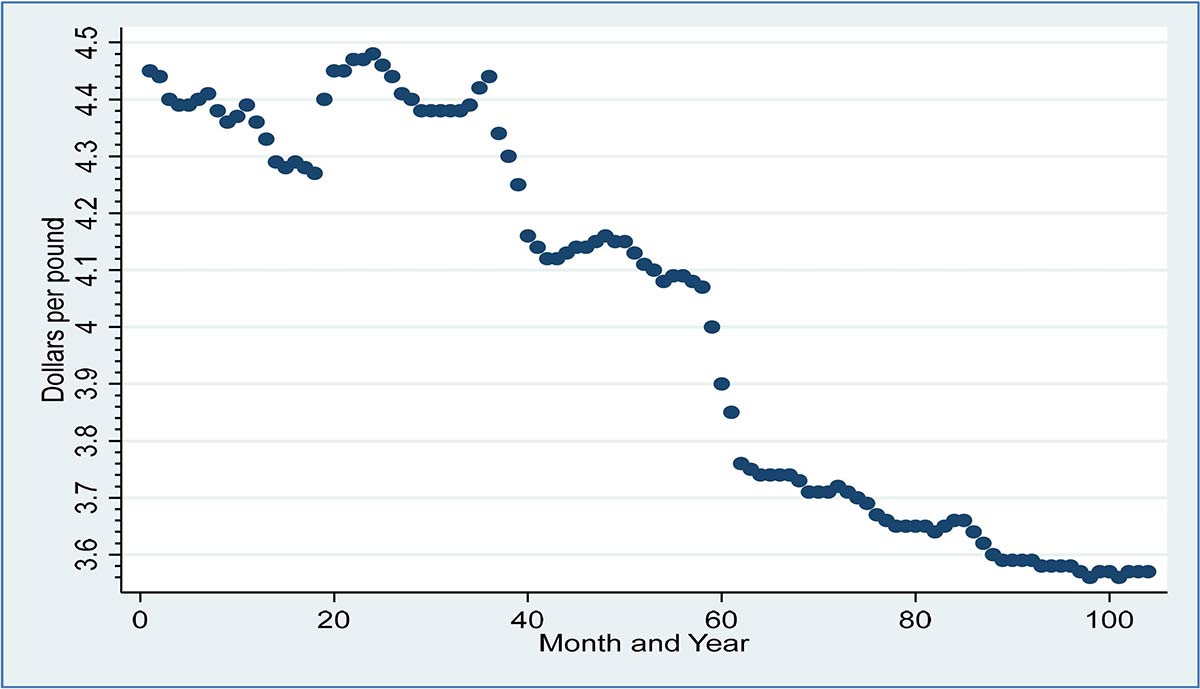

Direct Impacts on Wholesale Prices of Chinese Frozen Tilapia Fillets (3-5 Oz)

The estimated regression equation explained 87 percent of the variations in frozen tilapia fillet wholesale price. The detailed results of the regression analysis are not shown here. Only the significant effects of explanatory variables, especially time, months, and COVID-19, are summarized. The equation used in Stata-16 to measure the direct impacts of COVID-19 on wholesale prices of frozen tilapia fillets is as follows:

regress frozen352 time timesq i.feb i.mar i.apr i.may i.jun i.jul i.aug

i.sep i.oct i.nov i.dec totalmil fresh352 dtwex i.covid19, vce(r)

Regression results confirmed a significant U-shaped price curve for the 3-5 oz imported frozen tilapia fillets. The COVID-19 pandemic was significantly forcing the frozen tilapia fillet wholesale price downwards. The Trade Weighted U.S. Dollar Index wielded slightly adverse effects on the wholesale price of imported frozen tilapia fillets. The wholesale price of fresh tilapia fillet exerted a significant adverse impact on frozen tilapia fillet (3-5 oz) wholesale price.

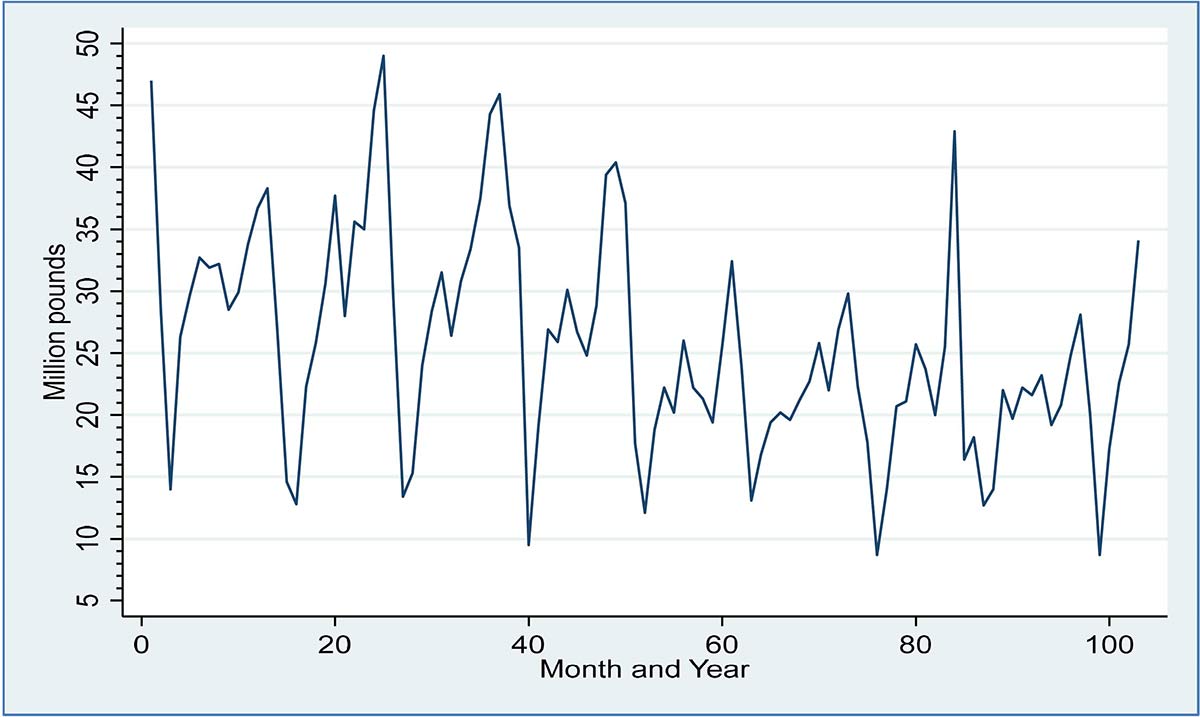

Direct Impacts on Imports of Frozen Tilapia Fillets from Asia

U.S. seafood imports create sales, jobs, income, value-added, and tax impacts on the economy. Data from NOAA Fisheries showed that in 2017, U.S. seafood imports produced a total economic contribution amounting to $81 billion, created 257,000 jobs, generated $13 billion income, and increased value-added by $25 billion.

The estimated regression equation explained 70 percent of the variations in frozen tilapia fillet imports. The detailed results of the regression analysis are not shown here. Only the significant effects of explanatory variables, especially time, months, and COVID-19, are summarized. The equation used in Stata-16 to measure the direct impacts of COVID-19 on frozen tilapia fillet imports is as follows:

regress frozenmil time timesq i.feb i.mar i.apr i.may i.jun i.jul i.aug

i.sep i.oct i.nov i.dec frozen352 dtwex i.covid19, vce(r)

Imports of frozen tilapia fillets seemed to be significantly lower from March to June and August to November. The COVID-19 pandemic exerted insignificant positive effects on imports of frozen tilapia fillets. The Trade Weighted U.S. Dollar Index wielded slight positive effects on imports of frozen tilapia fillets. The wholesale price of frozen tilapia fillets (3-5 oz) did not significantly affect frozen tilapia fillet imports.

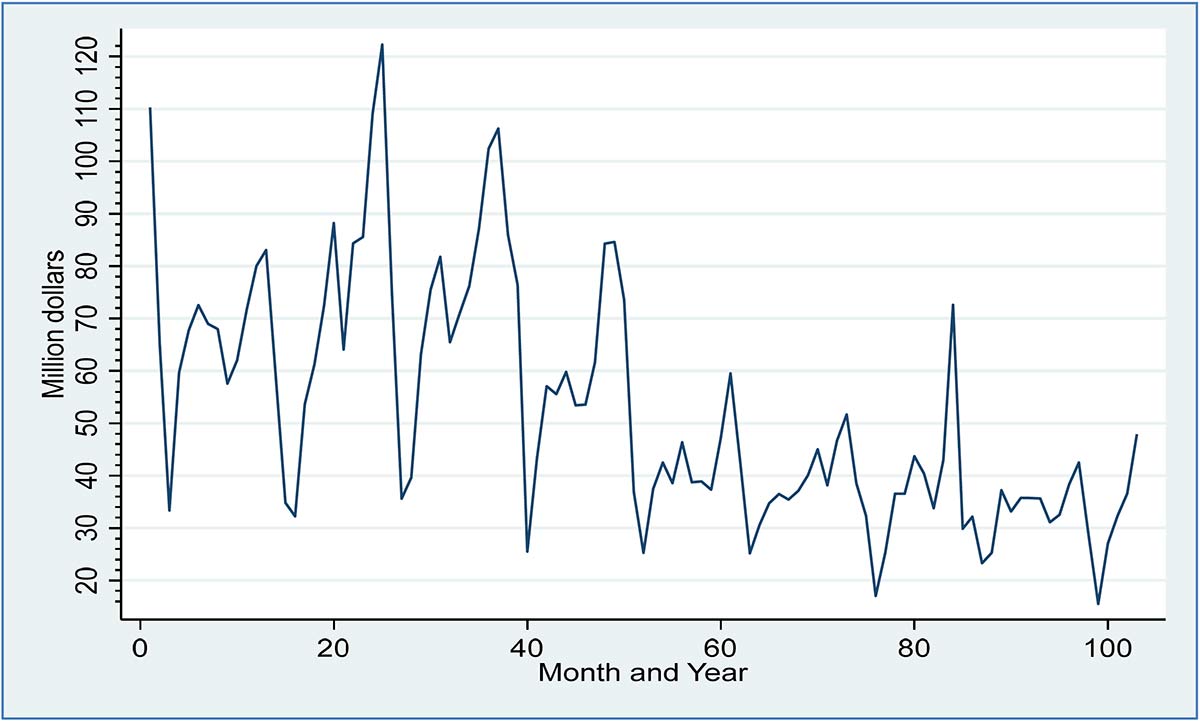

Direct Impacts on Import Expenditures on Frozen Tilapia Fillets from Asia

The estimated regression equation explained 78 percent of the variations in expenditures on frozen tilapia fillet imports. The detailed results of the regression analysis are not shown here. Only the significant effects of explanatory variables, especially time, months, and COVID-19, are summarized. The equation used in Stata16 to measure the direct impacts of COVID-19 on expenditures on frozen tilapia fillet imports is as follows:

regress frozendolmil2 time timesq i.feb i.mar i.apr i.may i.jun i.jul i.aug

i.sep i.oct i.nov i.dec frozen352 dtwex i.covid19, vce(r)

Expenditures on imports of frozen tilapia fillets declined over time and significantly higher from December to February. The spending of importers on frozen tilapia fillets was negatively affected, but not significant, during the COVID-19 pandemic. The Trade Weighted U.S. Dollar Index wielded slightly adverse effects on expenditures on imports of frozen tilapia fillets. The wholesale price of frozen tilapia fillet (3-5 oz) did not significantly affect expenditures on frozen tilapia fillet imports.

MarketMaker Seafood Businesses

More than 12,000 businesses that catch, process, and sell seafood products are registered in MarketMaker nationwide. There are more than 200 businesses that promote their seafood products and services in Mississippi MarketMaker. To search for seafood businesses in MarketMaker, perform the following procedures:

- Go here

- Click “search” and type “Fish/Seafood/Shellfish” in the product box.

- You can sort the search results by relevance and name.

- You can also limit online searches by state and type of business

SUMMARY OF TILAPIA SUPPLY AND CONSUMPTION

- U.S. tilapia production had been stagnant or declining after reaching its peak production in 2010-12 at almost 22 million pounds, valued at more than $53 million.

- U.S. tilapia imports reached their peak in 2012-14 at more than 500 million pounds, valued at over a billion dollars.

- Consequently, total supply was at its highest in 2012-14 at around 525 million pounds, valued at $1.1 billion.

- The apparent per capita tilapia consumption and expenditure also peaked in 2012-14 at 1.66-1.68 pounds per person or $3.30-3.64 per person.

SUMMARY OF ALL TILAPIA IMPORTS

- The U.S. depends on imports for 96 percent of its supply of tilapia products.

- The U.S imported an average of 35.5 million pounds of tilapia products per month since 2015, valued at $60.5 million per month.

- Tilapia fillets retail prices were significantly higher during COVID-19 months.

SUMMARY OF FROZEN TILAPIA FILLET IMPORTS

- The U.S. imports 23.3 million pounds of frozen tilapia fillets from Asia, valued at $41.1 million per month.

- The primary supplier of frozen tilapia fillets is China.

- The COVID-19 pandemic exerted insignificant positive effects on imports of frozen tilapia fillets.

- The wholesale price of frozen tilapia fillets did not exert any significant effect on frozen tilapia fillet imports.

- Imports of frozen tilapia fillets seemed to be significantly lower from March to June and August to November.

- The Trade Weighted U.S. Dollar Index wielded slight positive effects on imports of frozen tilapia fillets.

SUMMARY OF EXPENDITURES ON FROZEN TILAPIA FILLET IMPORTS

- The U.S. imports 23.3 million pounds of frozen tilapia fillets from Asia, valued at $41.1 million per month.

- The primary supplier of frozen tilapia fillets is China.

- Expenditures on imports of frozen tilapia fillets declined over time and significantly higher from December to February.

- The expenditures of importers on frozen tilapia fillets were negatively affected, but not significant, by the COVID-19 pandemic.

- The Trade Weighted U.S. Dollar Index wielded slightly adverse effects on expenditures on imports of frozen tilapia fillets.

SUMMARY OF FRESH TILAPIA FILLET IMPORTS

- The U.S. imports 4.3 million pounds of fresh tilapia fillets, valued at $12.6 million per month.

- Fresh tilapia fillets are supplied by Central and South America, mostly by Colombia and Honduras recently.

- The imports of fresh tilapia significantly declined over time and during fall season.

- During the COVID-19 period, imports of fresh tilapia fillets significantly increased.

- The Trade Weighted U.S. Dollar Index seemed to have insignificantly exerted positive impacts on imports of fresh tilapia fillets.

- The wholesale price of 3-5 oz fresh tilapia fillets exerted an insignificant effect on frozen tilapia fillet imports.

SUMMARY OF EXPENDITURES ON FRESH TILAPIA FILLET IMPORTS

- The U.S. imports 4.3 million pounds of fresh tilapia fillets, valued at $12.6 million per month.

- Fresh tilapia fillets are supplied by Central and South America, mostly by Colombia and Honduras recently.

- The expenditures on U.S. imports of fresh tilapia fillets significantly declined over time and during spring and fall seasons.

- The expenditures of U.S. importers on fresh tilapia fillet imports significantly rose during the COVID-19 pandemic.

- The Trade Weighted U.S. Dollar Index seemed to have significantly exerted negative impacts on expenditures on imports of fresh tilapia fillets.

- The wholesale price of 3-5 oz fresh tilapia fillet exerted significant direct effects on expenditures on fresh tilapia fillet imports.

SUMMARY OF FROZEN WHOLE TILAPIA IMPORTS

- The U.S. imported 7.6 million pounds of frozen whole tilapia from Asia, valued at $6.1 million per month.

MY TILAPIA ECONOMICS PUBLICATIONS

Posadas, Benedict C. U.S. Tilapia Production and Imports, Farm-gate, Retail and Wholesale Prices. Mississippi MarketMaker Newsletter, Vol. 10, No. 9. September 30, 2020. http://extension.msstate.edu/newsletters/mississippi-marketmaker.

Posadas, Benedict C. 2020. Economic Impacts of COVID-19 on Tilapia Consumption, Production, Imports and Prices. Horticulture, Marine, and Disaster Economics Outreach. Mississippi State University Coastal Research and Extension Center, Biloxi, Mississippi. https://youtu.be/mtLeiAUT8OQ

Posadas, Benedict C. 2020. Economic Impacts of COVID-19 on Tilapia Imports, Retail and Wholesale Prices. Horticulture, Marine, and Disaster Economics Outreach. Mississippi State University Coastal Research and Extension Center, Biloxi, Mississippi. https://youtu.be/f3rxcfWTD5o

Posadas, Benedict C. 2000. Tilapia Marketing in the Northern Gulf of Mexico Region. Pages 91-99 in Costa-Pierce, B. C. and J. E. Rakocy (eds.). Tilapia Aquaculture in the Americas. Vol. 2. World Aquaculture Society, Baton Rouge, Louisiana.

Fitzsimmons, Kevin, and Benedict C. Posadas. 1997. Consumer Demand for Tilapia Products in the U.S. and the Effects on Local Markets in Exporting Countries. In The Proceedings of the Fourth International Symposium on Tilapia Aquaculture, 4:613-632. Northeast Regional Agricultural Engineering Service, Ithaca, New York.

Homziak, J., and B. Posadas. 1992. Preliminary Survey of the Tilapia Markets in North America. In The Proceedings of the Forty-Second Annual Gulf and Caribbean Fisheries Institute, 42:83-102.