P4125

Knowing Your Agricultural Lenders I: Farm Credit System

Introduction

Running a farm or ranch often involves seizing opportunities to grow—whether it’s expanding acreage, upgrading equipment, or investing in infrastructure. These improvements, however, can come with significant costs. While some producers may have the cash on hand to fund these investments, many will need external financing. Fortunately, a variety of agricultural lenders are available, including the Farm Service Agency (FSA), commercial banks, insurance companies, equipment financing firms, and more.

This publication—first in the Knowing Your Agricultural Lenders series—introduces the Farm Credit System (FCS), a unique cooperative lending network dedicated to serving agriculture and rural communities.

Establishment of FCS and Recent Developments

FCS was created by Congress in 1916 to provide American farmers with a stable and dependable source of credit. As the nation’s oldest government-sponsored enterprise, FCS consists of a network of federally chartered, cooperatively owned lending institutions.

FCS is regulated and supervised by the Farm Credit Administration (FCA), while the Farm Credit System Insurance Corporation (FCSIC) ensures timely payment of debt securities issued systemwide. These securities, managed by the Federal Farm Credit Banks Funding Corporation, help raise capital for FCS lending activities. Additional funds are raised through the issuance of common and preferred stock.

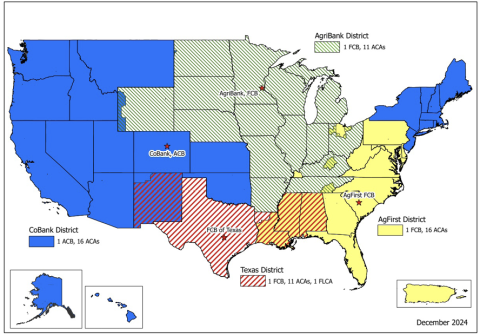

The system is organized into four funding banks:

- AgFirst Farm Credit Bank

- AgriBank

- Farm Credit Bank of Texas

- CoBank

These banks supply capital to 56 local Agricultural Credit Associations (ACAs), each serving a designated region. Mississippi is served by both AgFirst and the Farm Credit Bank of Texas, with three associations operating in the state: First South Farm Credit, Mississippi Land Bank, and Southern AgCredit.

Each association functions as a direct lender, offering a full range of credit services tailored to agriculture.

As of 2024, FCS represents approximately 40 percent of all farm production loans and 49 percent of farmland real estate loans in the U.S., making it one of the largest agricultural lenders by volume. One of the key advantages of the system is its alignment with producers’ needs; FCS offers flexible loan terms and employs loan officers who are well-versed in local agricultural markets.

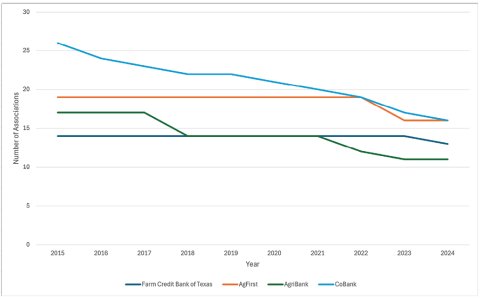

Like other segments of the finance industry, FCS has undergone consolidation in recent years.

Between 2015 and 2024:

- CoBank’s district experienced a 38.5 percent reduction in the number of associations, declining from 26 to 16.

- Farm Credit Bank of Texas had the lowest rate of consolidation, with just one merger in the past decade—a 7.1 percent reduction.

These changes reflect broader efforts to streamline services and improve operational efficiency across districts.

Advantages of FCS

There are several advantages of FCS as they specialize in agricultural and rural lending. One of the largest differences is their patronage refund system, which effectively reduces borrowing costs for its members.

Long-Term Financing Options

FCS is specifically designed to meet the financial needs of agricultural businesses, ranchers, and rural homeowners. Its loan products are often better suited to the unique cash flow cycles and risks associated with farming and rural living. They also offer long-term financing—ideal for purchasing farmland, buying equipment, or financing infrastructure projects. The repayment terms are often flexible, allowing borrowers to manage their cash flow better over the long run.

Flexible Loan Terms

FCS provides flexible loan structures, including fixed and variable-rate loans, which allows borrowers to choose what best suits their financial situation. Additionally, they may offer flexible repayment schedules that align with the seasonal nature of agricultural cash flow. In some cases, FCS may provide a fixed interest loan package for long-term loans (such as 10- or 30-year loans), which may not be provided from other types of lenders. Also, many loans issued by FCS have the option of a once-per-year (annual) loan payment schedule, unlike the monthly payments required by other types of lenders.

Patronage Distribution of FCS and Recent Trends

One of the greatest benefits of using FCS is patronage distribution. As cooperatives, FCS associations distribute a portion of their earnings back to their members through patronage dividends. Producers who borrowed money from FCS receive a portion of the lender’s profits back through patronage distribution. This can be in the form of cash payments, allocated equity, or a combination of both.

For example, suppose you take out a loan with an 8.5 percent interest rate from a local FCS association. At a designated time of the year, your lender distributes patronage, and you receive a 1 percent refund. Your effective interest rate is now 7.5 percent, after factoring in the refund. This process effectively lowers borrowing costs, strengthens member relationships, and reinforces the cooperative model by ensuring that profits benefit the borrowers who generate them.

In recent years, several FCS associations have significantly increased their patronage distributions, mostly driven by increased loan volume, setting new records for returning earnings to members. For instance, Farm Credit East announced a record $140 million patronage distribution for 2024, effectively reducing borrowers’ interest rates by 1.25 percent. Similarly, Farm Credit Mid-America plans to return $260 million in 2025, marking the largest distribution in its history and bringing its total patronage returned since 2016 to more than $1.5 billion.

Other associations, such as AgTrust Farm Credit and Farm Credit Services of America, have also expanded their patronage programs, ensuring that a greater portion of earnings is reinvested into the agricultural economy through member returns. Overall, the patronage distribution amount increased from $1.5 billion to $3.1 billion between 2015 and 2024 for the entire FCS. It must be noted that there are some regional variations and timing differences. These regional disparities underscore the diverse financial strategies and priorities within FCS, as each funding bank balances returning earnings to members with maintaining long-term financial sustainability.

While patronage distribution is a significant benefit, it is not guaranteed. When evaluating loan options, other loan terms beyond patronage should be considered. However, the patronage distribution of local FCS associations should not be overlooked. By reducing effective interest rates, these distributions ease financial burdens on farmers and agribusinesses, allowing them to reinvest savings into operations, expansion, and innovation.

Additionally, strong patronage programs reinforce borrower loyalty and trust in the cooperative model, distinguishing FCS institutions from traditional lenders. As patronage remains a key component of the FCS structure, its continued growth will play a vital role in supporting American agriculture in an increasingly competitive economic landscape.

FCS in Mississippi

Mississippi is served by three FCS associations, each covering different parts of the state:

Loan applicants should be prepared to provide more documentation than a personal ID and credit history. Typical requirements include:

- tax returns

- balance sheets and income statements

- business plan

- collateral documentation

These documents help lenders evaluate the viability of your operation and ensure appropriate loan structuring.

Reference

Farm Credit Administration. (n.d.).

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 4125 (POD-07-25)

By Heather Gladney, Graduate Student, and Kevin Kim, PhD, Assistant Professor, Agricultural Economics.