P4131

Small Farm Business Basics: Planning, Records, Finances, and Pricing

Farmers often face uncertainty about changing markets and price fluctuations, rising costs, or unpredictable weather. That is why planning is important. Planning for the future will help you navigate uncertainty and make better-informed decisions. Setting both personal and business goals helps you focus your time, money, and energy. Your goals—such as generating a living wage, expanding operations, entering new markets, achieving work-life balance, or transitioning the farm to the next generation—should guide the decisions you make on the farm. For example, choices like upgrading equipment, expanding acreage, or adopting new technology may look different for a part-time farmer than for a full-time farmer relying on the farm as their primary source of income.

Farm Business Planning

Running a farm means managing more than just crops, you are managing a business. And like any business, success depends on planning production, marketing, and finances. These three areas—operations and production, marketing, and finances—are all connected; what and how you produce affect how and where you market it, and these factors impact farm profits.

- Operations and production: Start by evaluating your available resources, including land, labor, capital, and equipment. Based on your short- and long-term goals, determine what crops or livestock to produce, the planting or production schedule, and the right mix or assortment of crops and products to match your target markets. If you sell directly to consumers (e.g., farmers markets) consider always offering a diverse mix of products and extending your season by having different seeding times. If you are considering new enterprises/crops, assess whether you have the necessary knowledge or identify where and how to learn about them.

- Marketing: This includes decisions about who to sell to (target market), at what price, and how and where to reach your target consumers. Choosing the right market outlet is important. Wholesale or retail channels may allow for larger volumes, but prices may be lower, while direct-to-consumer outlets (e.g., farmers markets, roadside farm stands) often involve more limited demand, but you have more control over prices. Consider that prices, volume, product quality, post-harvest handling, and packaging requirements will vary across outlets.

- Finances: This includes tracking both income and expenses, planning for capital needs, and managing cash flow. Consider what funds are needed to begin production and invest in infrastructure or equipment, both in the short and long term. Think about financing options, including farm loans or grants, and evaluate whether you are eligible and prepared to apply for them.

- Financial resources: In addition to commercial banks and the farm credit system, the U.S. Department of Agriculture Farm Service Agency (FSA) offers a variety of loan and grant programs. If you are a beginning farmer, you can learn about FSA’s Beginning Farmers and Ranchers Loan Program. You can also learn more about eligibility requirements and the application process.

Recordkeeping

Having goals is just the starting point. Tracking your numbers is what makes those goals measurable and achievable, and it starts with having good records. Keep in mind that it is difficult to manage what you do not measure. Clear, accurate records help you track income and expenses as well as other aspects of your operation.

Maintaining, organizing, and classifying farm records is essential for understanding how your farm is doing. This includes keeping track of daily transactions such as sales, input purchases, labor, and equipment use. Do not rely on memory alone! Accurate records help you measure production costs, identify problematic areas, and develop realistic budgets for the next season. Beyond being useful for taxes, good records give you the information you need for planning, accessing credit, etc.

Some important types of records to keep:

- Production/field records: Field size, varieties planted, seed/plant source, planting date, input use (e.g., fertilizer, pesticides), yield, field history (what was planted and when, pest problems).

- Harvest records: Crop harvested, date of harvest, quantity harvested (yield), quality, location (harvest field, plot).

- Sales and marketing records: Revenue generated across all crops and market channels. Keep records related to your sales (quantity and prices): What? When? How much? Where?

- Financial records: Essential for developing key financial records, the following financial statements are recommended for farmers to maintain and are commonly required by lenders during any loan application process:

- Income statement

- Income – money received from sales or services

- Expenses – money paid for inputs and services

- To learn more, refer to Mississippi State University Extension Publication 3707 Farm Financial Analysis Series: Income Statement .

- Income statement

- Balance sheet

- Assets – items of value, both physical and monetary, including depreciation

- Liabilities – money owed to others

- Equity – owners net worth/equity

- To learn more, refer to MSU Extension Publication 3713 Farm Financial Analysis Series: Balance Sheet. To learn more about financial recordkeeping, refer to MSU Extension Publication 4088 How to Keep Good Records on the Farm.

- Other records: Labor (e.g., hours spent on specific crops or tasks, compensation), buildings, equipment and maintenance (e.g., purchase date and cost, depreciation, fuel use, hours use, repairs and maintenance).

Note: Keeping farm and personal finances separate is good practice. Separate farm records are useful for evaluating the profitability of your business.

From Recordkeeping to Planning: The Role of Budgets

Budgeting is where we take what happened in the past and use it to plan for the next season, helping you estimate costs and potential income. A budget is a management tool that helps you organize and account for the sources of income (revenue) and expenses of your business. You can also use published crop budgets for reference if you do not have previous expense records.

A good first step is to analyze your production from beginning to end, and to list and break down each cost into variable and fixed costs.

- Variable costs: Expenses linked to the level of production and sales. For example, for a vegetable farm, variable costs would be fuel, seeds, plant materials, fertilizers and pesticides, direct labor, and packaging materials.

- Fixed costs: Expenses related to operating your farm/business that do not necessarily change with the level of production or output. Some examples are rent, insurance, taxes, interest expenses, and depreciation on buildings or equipment.

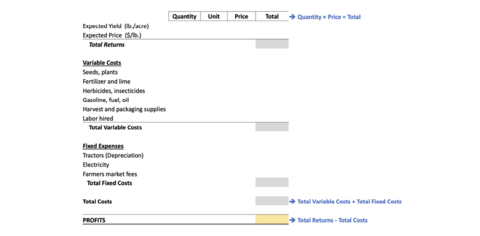

You can develop a budget for your entire farm business and an enterprise budget for each crop or product you have. Figure 1 shows an example of the lines generally included in a crop budget.

Cash Flow

A budget tells you what you expect to earn and spend. Cash flow tells you when it happens. A cash flow statement is helpful to plan the timing of cash needs, anticipate any need to borrow, and ability to repay loans.

A cash flow statement should list:

- Cash inflows: Money received from sales or money borrowed

- Cash outflows: Money paid out to cover expenses (e.g., purchase inputs, pay labor) or pay out loans

Table 1 provides an example of a cash flow statement.

To learn more about cash flow statements, refer to MSU Extension Publication 3710 Farm Financial Analysis Series: Cash Flow Statement.

Prices and Price Considerations

Pricing decisions directly affect the success of your farm business. Unlike other factors, pricing is often within your control, especially when selling through direct-to-consumer channels.

Often, farmers can underprice their products. This may happen when production costs are not fully tracked and understood. To avoid this, your first step should be to know your costs. Use your records and budgets to calculate all expenses involved in producing and bringing your crops to the market.

| Item/Description | January | February | December |

|---|---|---|---|

| Cash inflow | |||

| Initial cash | 100 | 50 | 200 |

| Cash from sales | 0 | 800 | 0 |

| Cash from loans received | 1,000 | 0 | 0 |

| Total cash | 1,100 | 850 | 200 |

| Cash outflow | |||

| Input purchases | 750 | 350 | 0 |

| Bills paid | 300 | 300 | 75 |

| Loan payment | 0 | 200 | 200 |

| Total expenditures | 1,050 | 850 | 275 |

| Net cash flow* | $50 | $0 | $(75) |

*Net cash flow is calculated monthly as the total cash received minus total expenditures, or cash paid out.

Note: Entries for March thru November were omitted in example for brevity.

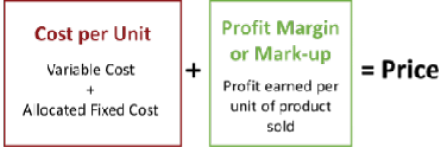

A common method is cost-based pricing, where you add a profit margin (percentage) or mark-up (dollar amount) to your total costs.

Setting prices is not just about covering costs, it also involves understanding the market. When determining your prices, consider:

Consumer demand: What do your customers want and value?

Competition: What are others charging? What is their product quality?

Product quality and value: Higher quality often justifies higher prices. You can add value by including recipes, attractive packaging, market local/sustainable story, etc.

Market outlet: Direct-to-consumer markets (like farmers markets or roadside farm stands) may allow for higher prices. In contrast, prices are often lower and set for you in wholesale markets.

Customer base: The socioeconomic background of your customers may influence what they are willing or able to pay.

It is important to make informed pricing decisions. Survey local markets, visit supermarkets, other farmers markets, grocery stores, and farm stands to see what similar products are selling for. Use this as a reference, but do not rely on it alone. Your pricing should always be grounded in a solid understanding of your total costs and the quality and value you provide.

Resources

- The following publications are available online at extension.msstate.edu/publications:

- MSU Extension Publication 4088 How to Keep Good Records on the Farm

- MSU Extension Publication 3707 Farm Financial Analysis Series: Income Statement

- MSU Extension Publication 3713 Farm Financial Analysis Series: Balance Sheet

- MSU Extension Publication 3710 Farm Financial Analysis Series: Cash Flow Statement

- MSU Extension Publication 3842 Understanding Farm Asset Depreciation and Tax Implications

- USDA FSA Farm Loan Programs

- USDA FSA Beginning Farmers and Ranchers Loans

- USDA resources, including FSA loan programs

This work is supported by the Extension Risk Management Education Program, project award no. 2023-70027-40446, from the U.S. Department of Agriculture’s National Institute of Food and Agriculture.

Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and should not be construed to represent any official USDA or U.S. Government determination or policy.

Publication 4131 (POD-08-25)

By Elizabeth Canales, PhD, Associate Professor, Agricultural Economics.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.

Authors

-

Associate Professor

Associate Professor- Agricultural Economics