Mississippi MarketMaker

Vol. 15, No. 12 / Impacts of Imported Shrimp Prices on U.S. Shrimp Dockside Prices

ABSTRACT

- This newsletter shows a proposed methodology in assessing the impacts of cheap imported shrimp on the dockside prices of shrimp harvested from the U.S. Gulf of America states (Penaeid species only) from January 2018 to July 2025.

- An econometric model was developed to measure the impacts of imported shrimp count 16-20 prices on the same U.S. shrimp count dockside prices.

- Preliminary results showed that the deflated dockside prices of Gulf white shrimp count 16-20 are significantly affected by the deflated wholesale prices of wild Gulf and imported farmed Asian and Latin American white shrimp count 16-20.

KEYWORDS

- Cheap shrimp imports, Gulf domestic dockside prices, Gulf and imported wholesale prices, and Gulf wild shrimp.

SUGGESTED CITATION

- Posadas, Benedict C. 2025. Impacts of Imported Shrimp Prices on U.S. Shrimp Dockside Prices. Vol. 15, No. 12. Mississippi State University Extension and Mississippi-Alabama Sea Grant Publication MASGP-25-058-12. December 17, 2025. https://extension.msstate.edu/newsletters/mississippi-marketmaker.

U.S. PER CAPITA SHRIMP CONSUMPTION

- Japan has the highest per capita shrimp consumption, at 7.23 pounds. The United States ranks second in per-capita shrimp consumption.

- Shrimp has been the most consumed seafood in the U.S. since 2001, surpassing canned tuna. It accounts for a significant portion of all seafood consumed by Americans, more than other popular species, such as salmon and tilapia, combined.

- U.S. per capita shrimp consumption reached its peak at 5.9 pounds per person in 2021 before slightly declining in 2022.

- The U.S. primarily relies on imports to meet this high demand, with approximately 94% of consumed shrimp being imported, mainly farmed shrimp from Asia and Latin America.

Source: AI Overview.

White shrimp, Litopenaeus setiferus;

Brown shrimp, Farfantepenaeus aztecus; and

Pink shrimp, Farfantepenaeus duorarum.

Source: https://www.fisheries.noaa.gov/find-species.

METHODS

- The dockside prices were compiled from the monthly reports prepared by NOAA Fisheries, Southeast Fisheries Science Center, Fisheries Statistics Division.

- U.S. shrimp prices are grouped by count per pound, namely 15 and below, 16-20, 21-25, 26-30, 31-35, 36-40, 41-50, and higher. Shrimp dockside prices were plotted against the exact wholesale shrimp count prices to identify graphical relationships.

- Wholesale prices were indexed to 2018 for confidentiality and plotted to show long-term monthly trends. The original wholesale prices are compiled from a paid data subscription.

- The econometric models of U.S. SHRIMP DOCKSIDE PRICES ($/lb) assume that the deflated dockside prices could be explained by:

- Month,

- Year,

- Deflated Gulf wild domestic wholesale prices,

- Deflated imported Asian farmed wholesale prices,

- Deflated imported Latin American farmed wholesale prices,

- Deflated diesel prices,

- Other variables.

- The Ordinary Least Squares (OLS) model of U.S. Shrimp Dockside Prices consists of the following dependent variable:

- Deflated dockside prices ($/lb).

- The U.S. Shrimp Dockside Prices Model is estimated by using the robust variance procedure of STATA-19.

- The variation inflation factor is calculated to detect the possible presence of multicollinearity.

- The marginal impacts are computed using the margins procedure.

SHRIMP DOCKSIDE PRICES VERSUS WHOLESALE PRICES

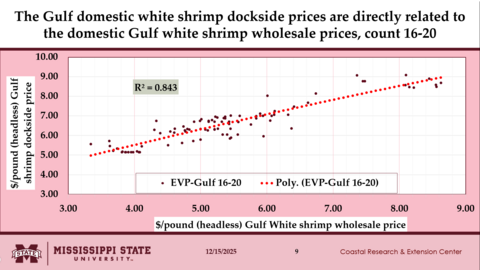

- The Gulf domestic white shrimp count 16-20 dockside prices are directly related to the domestic Gulf white shrimp count 16-20 wholesale prices (Fig. 2).

- This trend indicates that lower wholesale prices for Gulf shrimp tend to depress Gulf dockside prices.

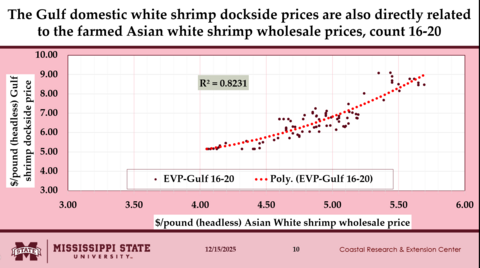

- The Gulf domestic white shrimp dockside prices (16-20) are also directly related to the farmed Asian white shrimp wholesale prices (16-20; Fig. 3).

- This trend indicates that lower wholesale prices for imported Asian shrimp tend to depress Gulf dockside prices.

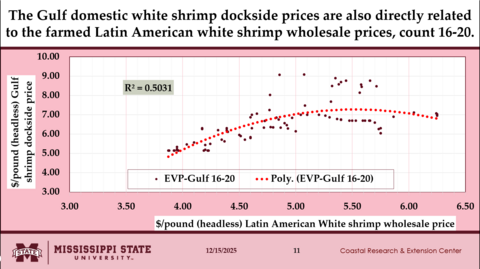

- The Gulf domestic white shrimp count 16-20 dockside prices are also directly related to the farmed Latin American white shrimp count 16-20 wholesale prices (Fig. 4).

- This trend indicates that lower wholesale prices for imported Latin American shrimp tend to depress Gulf dockside prices.

Figure 2

Figure 3

Figure 4

WHOLESALE SHRIMP PRICE INDEX (2018=100)

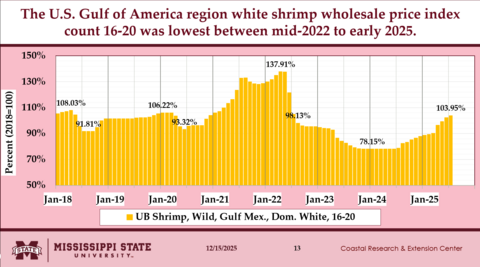

- The wholesale price of U.S. Gulf of America region white shrimp, count 16-20 was lowest between mid-2022 and early 2025 (Fig. 5).

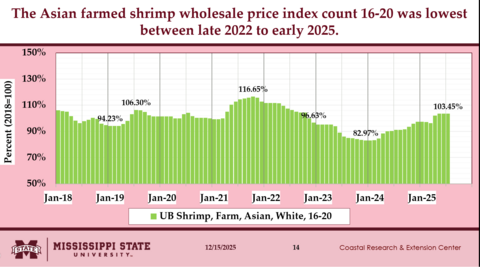

- The wholesale price of Asian farmed shrimp, count 16-20 was lowest between late 2022 and early 2025 (Fig. 6).

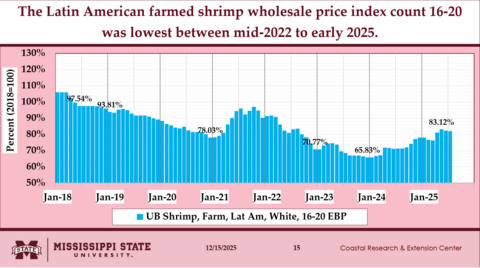

- The wholesale price of Latin American farmed shrimp, count 16-20 was lowest between mid-2022 and early 2025 (Fig. 7).

Figure 5

Figure 6

Figure 7

WHOLESALE PRICES OF GULF DOMESTIC SHRIMP ARE HIGHER THAN WHOLESALE PRICES OF IMPORTED FARMED SHRIMP

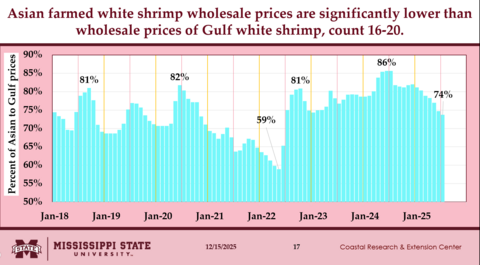

- Wholesale prices for Asian farmed white shrimp are significantly lower than those for Gulf white shrimp, count 16-20 (Fig. 8).

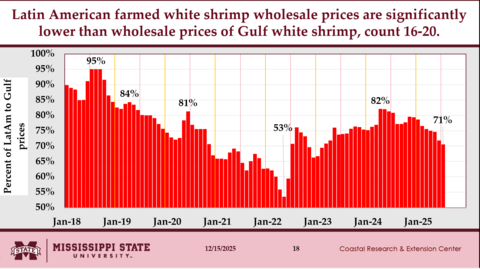

- Latin American farmed white shrimp wholesale prices are significantly lower than those of Gulf white shrimp, count 16-20 (Fig. 9)

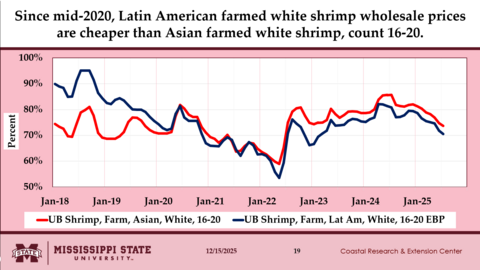

- Since mid-2020, Latin American farmed white shrimp wholesale prices have been lower than Asian farmed white shrimp, count 16-20 (Fig. 10).

Figure 8

Figure 9

Figure 10

RESULTS OF THE ECONOMETRIC MODEL

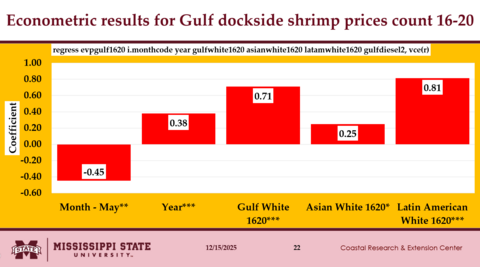

- The preliminary results for wild Gulf domestic white shrimp, count 16-20, deflated dockside prices, are shown in Fig. 11.

- Five independent variables showed statistically significant effects on wild Gulf domestic white shrimp, count 16-20 deflated dockside prices.

- Lower wild Gulf domestic white shrimp counts (16-20) deflated dockside prices are observed in May compared to January.

- Deflated wild Gulf domestic white shrimp dockside prices, count 16-20, are significantly affected by domestic wild Gulf white shrimp, count 16-20.

- Deflated wild Gulf domestic white shrimp dockside prices, count 16-20, are significantly affected by imported farmed Asian white shrimp, count 16-20.

- Deflated wild Gulf domestic white shrimp dockside prices, count 16-20, are significantly affected by imported farmed Latin American white shrimp, count 16-20.

Figure 11

SUMMARY, LIMITATIONS, AND IMPLICATIONS

- Preliminary results showed that the deflated dockside prices of wild Gulf domestic white shrimp count 16-20 are significantly affected by the deflated wholesale prices of wild Gulf domestic white shrimp count 16-20.

- The deflated dockside prices of wild Gulf domestic white shrimp count 16-20 are significantly affected by the deflated wholesale prices of imported Asian farmed white shrimp count 16-20.

- The deflated dockside prices of wild Gulf domestic white shrimp count 16-20 are significantly impacted by the deflated wholesale prices of imported Latin American farmed white shrimp count 16-20.

- The massive importation of significantly cheaper farmed shrimp from Asian countries exerted intense downward pressure on the dockside prices of wild Gulf domestic white shrimp count 16-20.

- The significant importation of farmed shrimp at lower prices from Latin American countries exerted robust downward pressure on the dockside prices of wild Gulf domestic white shrimp, count 16-20.

- In recent years, dockside prices for wild Gulf domestic shrimp have fallen to unsustainable levels, in some cases well below the cost of production.

- Since 94% of consumed shrimp are imported, these market conditions make it nearly impossible for many U.S. shrimpers to make a decent living.

ACKNOWLEDGEMENTS

- This newsletter is a contribution of the Mississippi Agricultural and Forestry Experiment Station and the Mississippi State University Extension Service. This material is based upon work supported in part by the National Institute of Food and Agriculture, U.S. Department of Agriculture, Hatch project under accession number 100004. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author. They should not be construed to represent any official USDA or U.S. Government determination or policy.

- This work was supported in part by the Mississippi-Alabama Sea Grant Consortium, National Oceanic and Atmospheric Administration, U.S. Department of Commerce, and the states of Alabama and Mississippi—federal grant number NA24OARX417C0155-T1-01. The statements, findings, conclusions, and recommendations are those of the authors and do not necessarily reflect the views of any of these funders.

ADDITIONAL NEWSLETTERS

- Mississippi MarketMaker. Vol. 15, No. 5 / Direct Revenue Impacts of Tariffs on U.S. Shrimp Imports. May 20, 2025

- Mississippi MarketMaker. Vol. 13, No. 12 / Direct Impacts of Disaster and Economic Events on United States White Shrimp Fisheries. December 13, 2023

- Mississippi MarketMaker. Vol. 13, No. 2 / Has the U.S. Saltwater Shrimp Aquaculture Industry Slowed Down During the Past Decade? February 21, 2023

- Mississippi MarketMaker. Vol. 12, No. 9 / Economic Impacts of Disaster Events on Gulf Shrimp Landings. September 14, 2022

- Mississippi MarketMaker. Vol. 12, No.8 / Effects of Higher Fuel and Lower Dockside Prices on Gulf Shrimping. August 11, 2022.

RECENT YOUTUBE VIDEOS

- 2025-39 IMPACTS OF IMPORTED SHRIMP PRICES ON U.S. SHRIMP COUNT 21-25 DOCKSIDE PRICES. https://youtu.be/NlczHqsO1-A.

- 2025-38 IMPACTS OF IMPORTED SHRIMP PRICES ON US SHRIMP DOCKSIDE PRICES. https://youtu.be/UV2qPgoT74E.

- 2025-37 GULF OF AMERICA SHRIMP DOCKSIDE PRICES. https://youtu.be/SRspGLpJgHY.

Authors

-

Extension/Research Professor

Extension/Research Professor- CREC-Coastal Research & Ext Center