P2420

Paying for a New Forest Without Cost-Share Funding

Reforestation cost-share funds are limited in many ways—some programs only pay for a limited number of acres, some only apply for certain situations, and sometimes the funding is simply insufficient for the number of applicants. Landowners who face this problem need to be aware that the federal and state tax systems provide a way to recover reforestation costs for commercial timber species. A reforestation deduction, amortization, and even a Mississippi tax credit are available to most taxpayers.

Taxpayers in the higher tax brackets may find that these tax incentives reduce costs better than cost-share. Plus, there is no waiting in line to qualify.

Federal Income Tax

Congress has recognized that private landowners need to recover reforestation expenses quickly. The current tax remedy is to allow the landowner to expense (deduct) up to $10,000 each year for the expenses incurred in reforestation. This limit is applied to each qualified timber property (QTP), not to each taxpayer. Any amount over $10,000 is amortized, or deducted over 84 months, using a specific formula.

These special provisions relate only to landowners growing commercial timber species. Landscaping trees or trees planted for personal use are not deductible under the federal provisions.

Lands that are in a trust follow a different rule. These landowners are not allowed to expense the first $10,000. They may amortize the entire amount, however, over the standard 84 months.

Allowable expenses include a wide variety of practices—whatever is reasonable and necessary to create a commercial forest with seedlings that are free to grow. These practices might include clearing land, raking, piling, burning, subsoiling, applying herbicides, bush-hogging, fertilizing, disking, and planting seedlings. Practices should be reasonable, ordinary, and necessary—generally what the forestry industry is willing to invest to establish a forest of commercially valuable species.

Let’s look at an example:

Ned and Nellie Rowan wanted to reduce their farming acreage and decided to plant 200 acres of cropland with loblolly pine trees. They applied for cost-share from the Natural Resource Conservation Service and the Mississippi Forestry Commission, but funds were not available. Instead of waiting 1 to 2 years for possible cost-share assistance, the Rowans decided to invest their own money into reforestation and recover costs with federal and state tax incentives.

In 2022, the Rowans hired a consulting forester to develop a reforestation plan, hire vendors, purchase seedlings, and ensure a quality job. The forester charged 5 percent above actual costs for this service. No site preparation was recommended because the land was still clean following an earlier crop harvest. A vendor agreed to plant 450 trees per acre for a fee of $50 per acre, or $10,000 for 200 acres. The Rowans chose to plant open-pollinated (OP) advanced loblolly pine bareroot seedlings at a cost of $65 per thousand. To achieve a planting density of 450 per acre (and including a 1 percent cull factor), they purchased 90,900 seedlings for $5,909. The total cost in 2022 to the Rowans was $16,704 ($15,909 plus 5 percent for the forester).

The Rowans considered this 200 acres as one qualified timber property. Therefore, the deduction limit was $10,000 on their federal income tax return. The remainder of $6,704 will be amortized over 84 months, or eight tax returns. The rules state that the first year’s amortization will be treated as if it occurred on July 1—in essence, a half-year’s deduction. A year’s deduction will be taken for the next 6 years. The final half-year’s deduction will be taken in year 8 (Table 1).

|

Tax incentives |

Amortization amount |

Tax deduction |

|

Deduction in 2022 |

10,000 |

|

|

Amortization basis |

$6,704 |

|

|

2022 |

1/14 |

$479 |

|

2023 |

1/7 |

$958 |

|

2024 |

1/7 |

$958 |

|

2025 |

1/7 |

$958 |

|

2026 |

1/7 |

$958 |

|

2027 |

1/7 |

$958 |

|

2028 |

1/7 |

$958 |

|

2029 |

1/14 |

$479 |

|

Ending basis in account $0 |

||

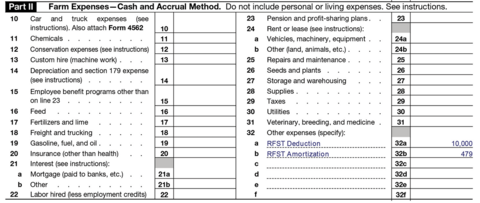

Because the Rowans are farmers, they will be able to claim reforestation expenses as part of their farming operation on Schedule F, Profit or Loss from Farming. In 2022, the initial deduction of $10,000 and $479 of amortization were reported as “other expenses” (Figure 1). Reforestation expenses are identified as “RFST” on tax forms.

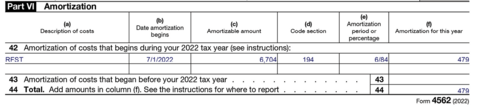

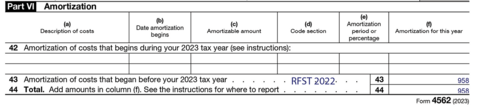

Amortization deductions are first recorded on Form 4562, Depreciation and Amortization, Part VI (Figure 2). The reference to Section 194 of the Internal Revenue Code guides the IRS agent handling the return to look up the provision. The amortized amount reported on Form 4562 is then transferred to Schedule F (Figure 1).

An election or notice is required for the first of these amortization deductions. The Rowans made their election in 2022 on a plain piece of paper, but they could have used Form T: Forest Activities Schedule, Part IV, Reforestation and Timber Stand Activities.

This election states how much was spent, the date they spent it, practices involved, species of timber planted, and the purpose of growing timber, as follows:

Under Section 194, we elect to amortize $6,704 of reforestation expenses in Any County, Mississippi. Payment was made on January 27, 2022. The 84-month amortization period begins July 1, 2022. The expenses were for planting improved loblolly pine seedlings for commercial timber production on the tract known as Granny B’s Farm.

For their 2023 tax return, the amortization deduction will increase to $958 as shown in Figure 3. They also will transfer the amortization deduction onto Schedule F (as shown in Figure 1). The Rowans will continue to file the appropriate amortization deduction until they have deducted all their reforestation costs.

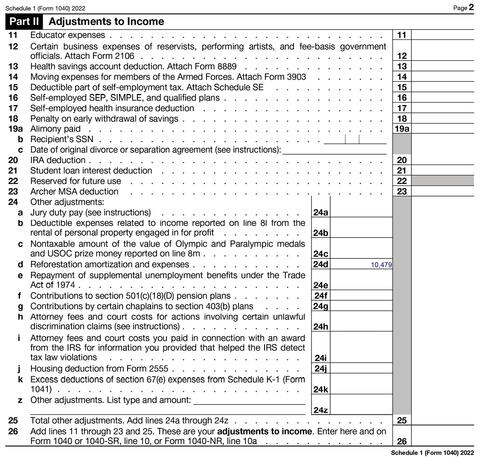

Only farmers should use Schedule F. If the forest is not part of a farming operation, it may be considered either a business or an investment. Business owners would use Schedule C or other appropriate business forms instead of Schedule F. Investors would file their initial deduction and amortization deduction in Part II (line 24d) of Schedule 1 (Form 1040) as shown in Figure 4 and then transfer to the front of Form 1040.

Mississippi Income Tax

Mississippi offers a nonrefundable tax credit for new forest establishment. The requirements are somewhat different than those for the federal tax incentives. Only Mississippi taxpayers reforesting Mississippi land they own may claim a credit on Form 80-315. The tax credit allows Mississippi taxpayers to recover up to 50 percent of the cost of qualified expenses.

Since the Mississippi Reforestation Tax Credit is applied to taxes owed, the taxpayer reduces his or her tax burden by the amount of the tax credit. This credit is much better than a deduction, where the reduction in taxes paid equals the amount of the deduction times the marginal tax rate. For example, a $100 tax credit reduces taxes by $100, but a $100 deduction for a taxpayer in the 25 percent tax bracket reduces taxes by $25.

Using the Mississippi Reforestation Tax Credit requires the services of a registered or graduate forester. The forester prepares a simple prescription of reforestation practices, including a map of the area and legal description of the property. This person also signs the Mississippi Reforestation Tax Credit form to certify that the plan was made and the work was carried out.

Consulting foresters routinely help landowners claim reforestation credit. Their services may be included as part of their duties following a timber sale. Otherwise, services are negotiated for a fee. Other sources of help are foresters who are also vendors who plant seedlings and/or prepare sites for planting. The Mississippi Forestry Commission office also can prepare a plan. The cost is a contract rate, based on the actual cost of providing the service.

There are other limitations on the use of the Mississippi Reforestation Tax Credit. Generally, tax credit and cost-share cannot be claimed for the same practice on the same acreage the same year. Both may be used at the same time only when a taxpayer’s adjusted gross income is below the federal income credit level. In 2022, this amount was $55,529 for a married couple filing jointly with two children. For the same conditions during 2023 and 2024, this amount will be $59,478 and $62,688, respectively.

For land owned by a pass-through entity such as a partnership or an s-corporation, the limits to using the tax credit apply to the pass-through entity level as well as to the investor. Married couples can each have a $10,000 credit if they own land individually and pay for practices on their individually owned properties. If their land is owned jointly, their total limit is $20,000 for the couple. Under the new law, the lifetime limit will be $75,000 per taxpayer.

Let’s see how the Rowans use the MSRTC:

The Rowans are Mississippi taxpayers planting trees on their property in Mississippi. Therefore, they are eligible to use the Mississippi Reforestation Tax Credit. Their consulting forester wrote the required plan for the Rowans as part of the total tree planting cost and oversaw the planting of trees.

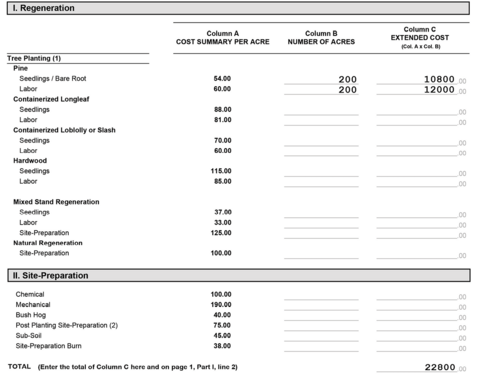

The Rowans filled out the cost worksheet for the Mississippi Reforestation Tax Credit (Form 80-315) as shown in Figure 5. Their consultant signed the form and mailed a copy of the worksheet to the Mississippi Forestry Commission as required.

The Mississippi Reforestation Tax Credit limits the per-acre cost of each practice. These limits are based on cost-share rates and are changed yearly. As a result, the amount eligible for the Mississippi Reforestation Tax Credit may be less than the actual amount spent. The lesser value is used to compute the 50 percent tax credit. In our example, the Rowans actually spent $16,704, and the allowable upper limit is $22,800 as determined by filling out the worksheet (Figure 5). The Rowans then transferred the lower value to the front of Form 80-315 and took a tax credit of 50 percent of $16,704, or $8,352. This reduced their Mississippi taxes by $8,352. If they are unable to use all the credit now, they will carry it forward until it is totally used.

After subtracting the tax credit, the remainder may be claimed as a reforestation deduction or amortization using federal guidelines. The Mississippi State Tax Commission has not rewritten the MSRTC regulations following the changes in federal reforestation tax due to the 2004 American Jobs Creation Act. We have used our best estimate of the way to handle these expenses. Check with your tax advisor for advice based on your particular facts and circumstances.

Net Investment

Using the federal tax incentives and Mississippi Reforestation Tax Credit enables landowners to recover a good portion of their reforestation costs. Each landowner’s actual recovery percentage will vary according to the marginal tax rate of the individual and the amount actually spent. If a landowner has taxable Mississippi income, it may be much more advantageous to use the Mississippi Tax Credit than to obtain cost-share funding for the forest establishment costs.

Returning to our example again:

The Rowans are in the 25 percent federal marginal tax bracket and the 5 percent Mississippi tax rate. For illustrative purposes only, it is assumed they have an annual state tax liability of $3,500. Since the Reforestation Tax Credit is nonrefundable, they can only offset their annual income tax liability. Their total expenses for reforestation were $16,704.

At the end of the eighth year, they had recovered $12,946 as shown in Table 2, or just over 77 percent of their investment. Of course, this does not take into account the time value of money, but it still shows a significant reduction in the cost of investing in a new forest. Note that the Mississippi state income tax rate will be reduced to 4.7 percent in 2024 and 4.4 percent in 2025.

|

Tax year |

Federal tax deduction |

Value of deduction (deduction x .25 federal marginal tax rate) |

Mississippi tax credit |

Mississippi tax deduction beyond tax credit |

Value of deduction (deduction x .05 state marginal tax rate) |

Total savings in taxes |

|

2022 |

$10,479 |

$2,620 |

$3,500 |

$8,352 |

$418 |

$6,537 |

|

2023 |

$958 |

$239 |

$3,500 |

$3,739 |

||

|

2024 |

$958 |

$239 |

$1,352 |

$1,591 |

||

|

2025 |

$958 |

$239 |

$239 |

|||

|

2026 |

$958 |

$239 |

$239 |

|||

|

2027 |

$958 |

$239 |

$239 |

|||

|

2028 |

$958 |

$239 |

$239 |

|||

|

2029 |

$479 |

$120 |

$120 |

|||

|

Savings in taxes |

$4,176 |

$8,352 |

$418 |

$12,946 |

Summary

We encourage landowners to compare tax incentives to cost-share. Your individual facts and circumstances will determine which is best. Tax incentives are very attractive, especially when landowners are placed on waiting lists for cost-share funds. Reforesting now with tax incentives will usually beat waiting 2 or 3 years for cost-share. Waiting for cost-share can increase site preparation costs by allowing weeds and brush to become well-established on the planting or seeding site. It also increases the wait for harvest returns from the new forest, thus reducing overall net returns. Many taxpayers who reforest their property may be pleased to find that their tax incentives could exceed cost-share payments in terms of cost recovery.

Information Sources

This publication provides some guidance to landowners who are ready to invest in a new forest without using cost-share. Your individual situation may not be exactly the same as the example used for illustration. In particular, lands held in trusts are not eligible for some of these provisions, and hobby owners are ineligible. For more details on taxation and forest establishment costs, visit http://extension.msstate.edu/natural-resources/forestry or www.timbertax.org. Here are several free publications that may provide further information on recovering the costs of establishing a new forest:

Farmer’s Tax Guide. IRS Publication 225. Available at www.irs.gov, or order from the IRS tax hotline at (800) 829-1040.

Timber Tax Overview. MSU Extension Publication 2307. Available at http://extension.msstate.edu/publications/timber-tax-overview or your local county MSU Extension office.

Tax Tips for Forest Landowners: 2023 Tax Year. U.S. Forest Service Publication (updated each year with changes in the federal tax code relating to forestry). Available at www.timbertax.org.

Form 80-315 Mississippi Reforestation Tax Credit and 80-315i Instructions for Mississippi Reforestation Tax Credit. Download current forms and instructions from the Mississippi Department of Revenue website at https://www.dor.ms.gov/Pages/Individual-Income-Forms.aspx. To request forms be mailed, call (601) 923-7000.

Publication 2420 (POD-10-24)

Revised by Curtis VanderSchaaf, PhD, Assistant Professor, Central Mississippi Research and Extension Center. Written by Stephen Dicke, PhD, Extension Professor (retired); James Henderson, PhD, Professor and Head, Coastal Research and Extension Center; and Deborah Gaddis, PhD, Extension Professor (retired), Forestry.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.

Authors

-

Associate Professor

Associate Professor- Central MS Research & Ext Center

-

Professor and Head

Professor and Head- CREC-Coastal Research & Ext Center